Key Takeaways:

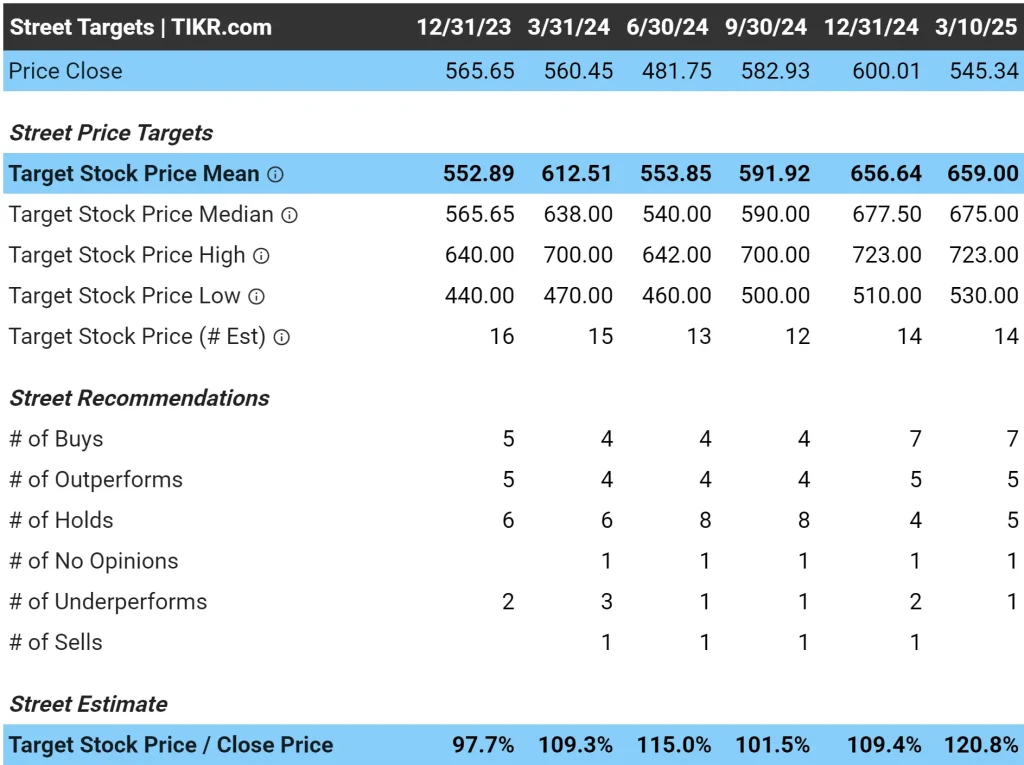

- MSCI is a boring, untouchable business in the financial industry, and analysts think the stock has about 20% upside today.

- CSX benefits from high barriers to entry in the railroad industry, making it a stable, essential business. Analysts also think this stock has about 20% upside today.

- Taiwan Semiconductor is an irreplaceable global chip leader, and analysts think the stock has about 40% upside.

- Get accurate financial data on over 100,000 global stocks for free on TIKR >>>

Some companies have such strong competitive advantages that they become nearly irreplaceable.

These businesses dominate their industries, generate high returns on capital, and maintain wide moats that protect themselves from competition.

Here are three wide-moat stocks that still look undervalued today. The first two look strong, but Stock #3 looks the most undervalued and could very well be the most important company in the world.

1: MSCI (MSCI)

MSCI is a financial data powerhouse that is pretty much irreplaceable in the asset management industry.

The company owns the underlying stock indexes that ETFs and asset managers base their funds on, which makes MSCI an essential part of global investing.

Why MSCI is a long-term compounder:

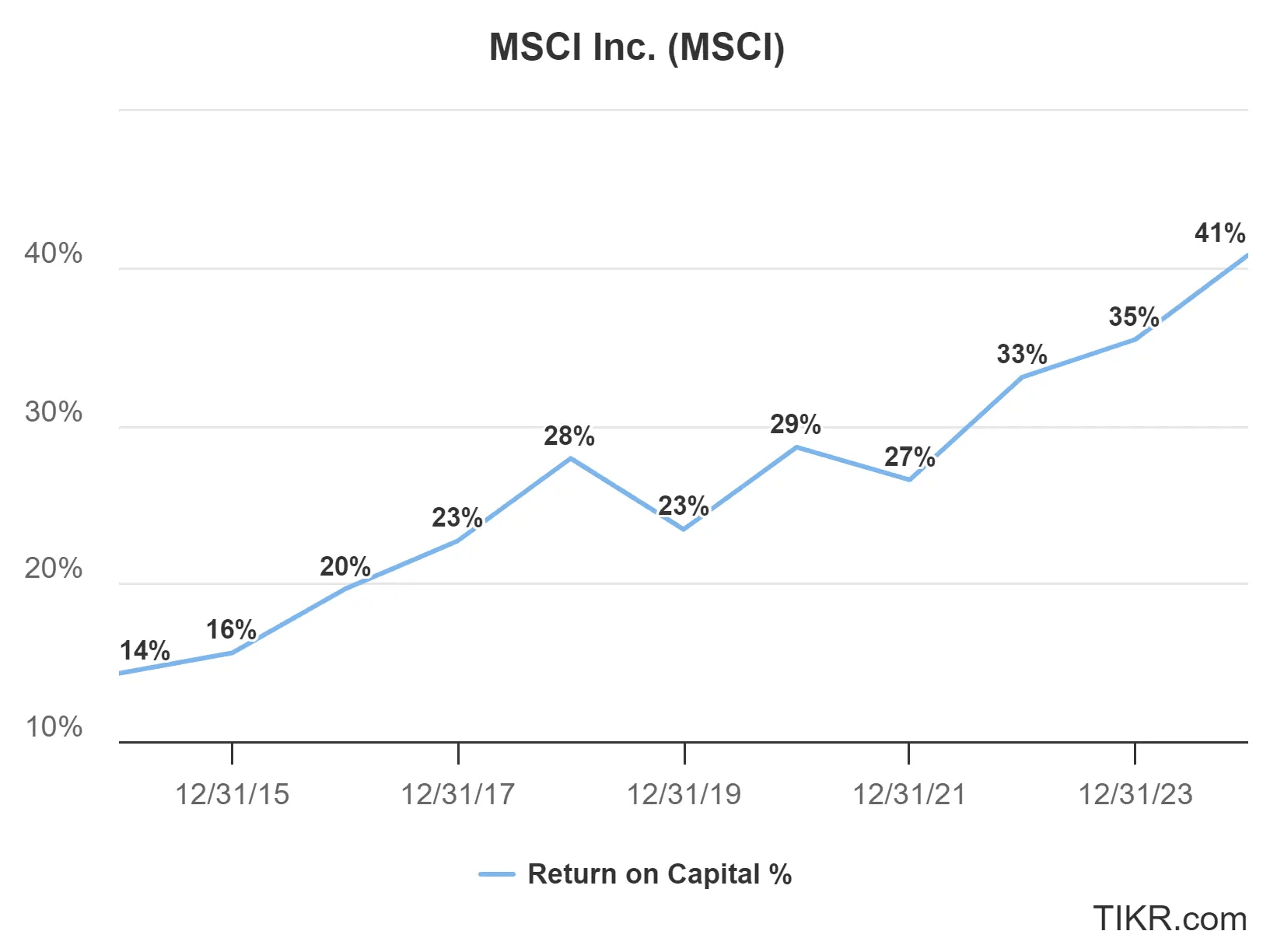

- The company earns extraordinary returns on capital and continues to expand margins.

- MSCI’s stock has grown at about 25% annually over the past 10 years.

Today, analysts see nearly 20% upside, which makes MSCI a high-quality stock available at a fair price.

Find wide-moat, undervalued stocks to buy today with TIKR >>>

2: CSX Corporation (CSX)

CSX is a leading U.S. railroad company, transporting goods like coal, chemicals, and agricultural products across the country.

Railroads have massive barriers to entry, as it is extremely difficult to build new rail lines in the U.S. This makes existing railroad companies like CSX virtually irreplaceable.

Analysts see nearly 20% upside for the stock, which could make CSX an interesting stock for further research at today’s price.

Why CSX has strong competitive advantages:

- Rail transport is more efficient than trucking, which makes railroads essential in our supply chain.

- The company benefits from stable, long-term demand for shipping goods.

CSX could be a good stock to buy and hold since it trades at a reasonable price today, and benefits from strong long-term demand and high barriers to entry.

Analyze stocks quicker with TIKR >>>

3: Taiwan Semiconductor Manufacturing (TSM)

Taiwan Semiconductor, or TSM, is the world’s largest semiconductor foundry, producing chips for companies like Apple, Nvidia, and AMD.

Since the entire world runs on semiconductors, TSM has become a nearly irreplaceable business.

TSM’s gross margins have increased over time due to the business’s significant pricing power.

Why TSM is one of the most important companies in the world:

- The company controls over 60% of the global chip manufacturing market.

- Advanced semiconductor production requires billions of dollars in investment, making it nearly impossible for competitors to catch up to TSM.

Analysts see around 50% upside for the stock, which makes TSM look attractive today.

With semiconductors driving modern technology, TSM remains a critical player in the global economy.

Find the best stocks to buy today with TIKR >>>

TIKR Takeaway

Companies with wide moats and strong competitive advantages tend to outperform over the long run.

MSCI, CSX, and Taiwan Semiconductor are all wide-moat businesses that look undervalued today.

The TIKR Terminal offers industry-leading financial data on over 100,000 stocks and was built for investors who think of buying stocks as buying a piece of a business.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. We aim to provide informative and engaging analysis to help empower individuals to make their own investment decisions. Neither TIKR nor our authors hold positions in any of the stocks mentioned in this article. Thank you for reading, and happy investing!