What is EV/EBIT?

EV/EBIT is a financial ratio that stands for Enterprise Value (EV) to Earnings Before Interest and Taxes (EBIT). This ratio helps long-term investors evaluate whether a company’s stock is fairly valued.

EV/EBIT measures the total value an investor would need to acquire a company (including debt obligations) relative to its operating income, or EBIT. Unlike other valuation metrics like the P/E ratio, which only considers the price for the company’s equity, EV/EBIT considers the total value of purchasing the business, including its debt.

EV/EBIT provides a more holistic view of a company’s valuation, making it one of the most popular valuation ratios among stock market investors.

Value stocks with the EV/EBIT ratio quicker with TIKR >>>

The EV/EBIT Formula

The formula for calculating the EV/EBIT ratio is:

EV / EBIT = Enterprise Value (EV) / Earnings Before Interest and Taxes (EBIT)

This ratio allows investors to assess how much it would cost to purchase the entire business compared to each unit of operating profit, making it one of the best tools for stock valuation.

Example of EV/EBIT Calculation

Example:

- Google’s Enterprise Value: $2,080 billion

- Google’s NTM (expected next 12 months) EBIT (Operating Income): $123 billion

NTM EV/EBIT = 2,080 / 123

NTM EV/EBIT = 16.9x

A ratio of 16.9 suggests that when investors buy Google stock and essentially “purchase” a portion of the business, they’re $16.90 for every $1 Google generates in operating earnings.

The EV/EBIT ratio is best used when compared to competitors or companies with similar growth forecasts and profitability.

It’s also a good sign to see that a stock is trading below its historical average EV/EBIT, especially if the stock still has strong fundamentals, growth, and margins.

Understanding Enterprise Value

Enterprise Value (EV) represents a company’s total value, encompassing its market capitalization, debt, and cash or cash equivalents. EV is significant because it reflects a company’s theoretical “takeover price,” or the true price to purchase the business after settling all debt obligations and collecting the company’s cash.

How to Calculate Enterprise Value

The formula for calculating Enterprise Value is:

EV = Market Capitalization + Total Debt – Cash and Cash Equivalents + Preferred Equity + Minority Interest

Example:

Let’s say Google has:

- Market Capitalization: $1,933.5 billion

- Total Debt: $28.7 billion

- Cash & Cash Equivalents: $100.7 billion

- Preferred Equity: $0

- Minority Interest: $0

In this example, Google’s enterprise value would be $1.86 trillion:

EV (billions) = $1933.5 + 28.7 – 100.7 + 0 + 0

EV = $1,861.5 billion

The enterprise value shows how much it would cost to acquire the entire business, assuming all debt is paid and the company is bought in cash.

EV vs. Market Capitalization

While market capitalization only considers a company’s equity value because it’s the number of total shares outstanding multiplied by the share price, enterprise value includes the company’s debt and cash and represents the purchase price of the total business. EV is generally a more accurate when comparing companies with different debt levels or assessing potential acquisition targets.

What is EBIT?

Earnings Before Interest and Taxes (EBIT) measures a company’s profitability before paying interest and taxes. EBIT focuses on a company’s operational efficiency, making it useful for evaluating its core business performance without the effects of its capital structure or tax environment.

Definition and Components of EBIT

EBIT is calculated as:

EBIT = Gross Profit – Operating Expenses

EBIT’s Components:

- Gross Profit: Revenue minus cost of goods sold. The cost of goods sold is the direct production or service costs associated with delivering or creating products or services.

- Operating Expenses: Costs associated with core operations, excluding interest and taxes.

Why is EBIT Used in Valuation?

EBIT is used in valuation because it isolates a company’s core operating performance, excluding the effects of capital structure and taxes. This is helpful because interest expenses and taxes can differ greatly between companies, so using operating income can help investors compare stocks on an apples-to-apples basis.

EBIT vs. Operating Income

EBIT and operating income are essentially the same thing and are used interchangeably. However, these figures can sometimes have subtle differences depending on how specific expenses (like non-operating income or extraordinary items) are categorized.

If there is a difference between EBIT & operating income, EBIT is considered more comprehensive because it includes all operating expenses before interest and taxes.

Comparing EV/EBIT Across Industries

EV/EBIT ratios vary widely by industry due to differences in profitability, growth prospects, and risk profiles. It’s often best to compare a company’s EV/EBIT ratio to its industry peers to see if a business may be undervalued.

Find the best stocks to buy today with TIKR >>>

What is a High or Low EV/EBIT Ratio?

There’s no universal “good” or “bad” EV/EBIT, but here are some general guidelines:

- High EV/EBIT Ratio: Generally, an EV/EBIT above 20 is considered a high EV/EBIT and might show that the stock is overvalued, but 20x multiples are pretty typical for growth companies. Companies with strong growth potential, such as tech firms, often have higher EV/EBIT ratios because the market anticipates rapid earnings growth and is willing to pay a premium. Long-term investors should be cautious, especially if the ratio significantly exceeds industry benchmarks.

- Low EV/EBIT Ratio: Generally, an EV/EBIT ratio below 10 is considered a low multiple and could show that the stock is undervalued. Established, stable companies with slower growth, such as utilities, often naturally have lower EV/EBIT ratios. However, a low ratio could also reflect problems in a company’s underlying business, like declining profitability, poor management, or poor growth expectations. That’s why it’s important to find stocks with strong fundamentals that also happen to trade cheaply.

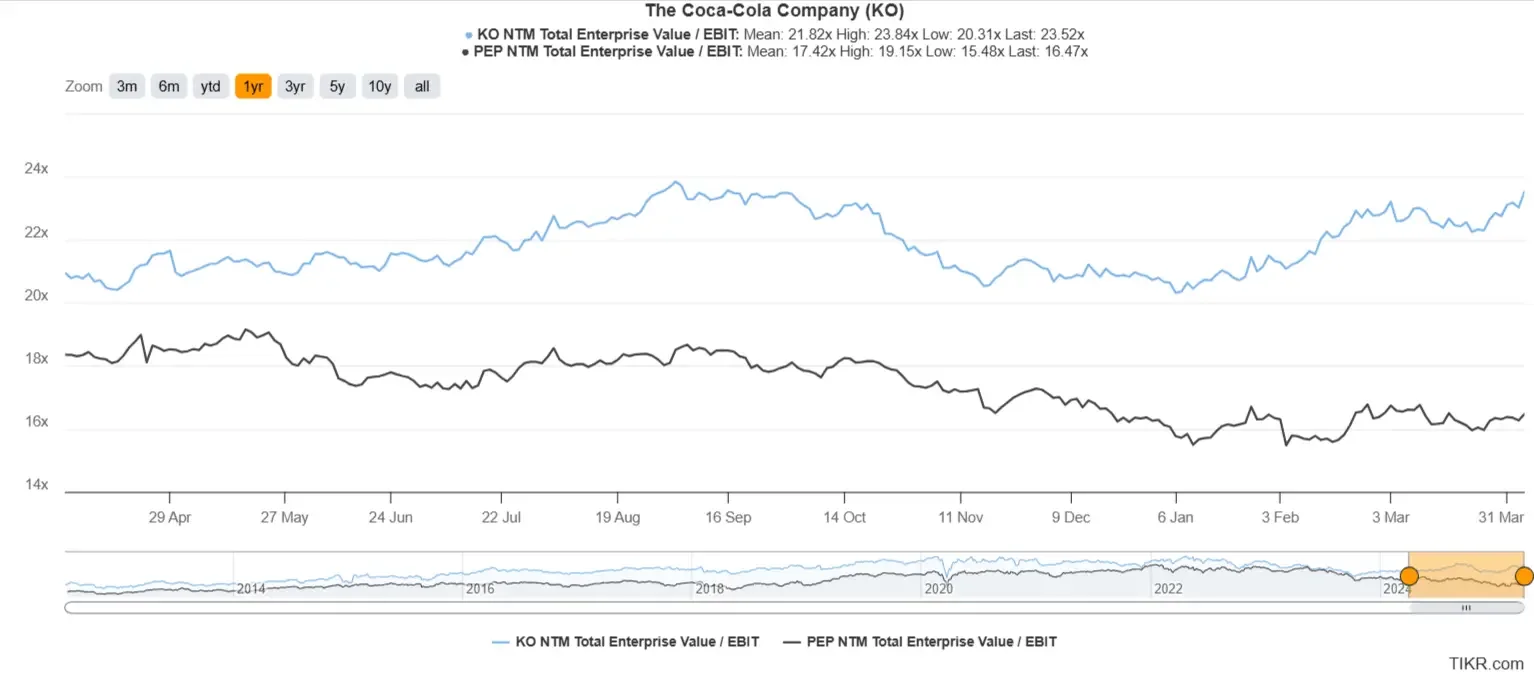

Case Study: Coca-Cola vs Pepsi

Today, Pepsi (PEP) trades at a much cheaper EV/EBIT valuation than Coca-Cola (KO). But, we’ll analyze both businesses to see whether Pepsi is cheaper than Coca-Cola or if Coca-Cola has a stronger business that justifies the premium price multiple:

Margin Profile

Companies with higher profitability rates tend to trade at a higher valuation than less profitable companies. Coca-Cola has much higher EBIT margins compared to Pepsi, and both companies are expected to see slight margin growth:

Growth Forecast

Companies expected to see high growth tend to trade at higher multiples because investors are willing to pay more today for a business that will be worth more tomorrow.

Pepsi is expected to see slightly higher EBIT growth next year than Coca-Cola:

Is Coca-Cola or Pepsi a Better Buy?

So Coca-Cola trades at a higher EV/EBIT multiple than Pepsi, but it doesn’t necessarily mean that Coca-Cola is more expensive than Pepsi. Coca-Cola is also a higher-quality business because it has much higher operating margins.

Ultimately, it’s important for investors to analyze all aspects of a business, like a company’s growth forecast, profitability, financial safety, and dividend policy, to assess whether a business is a good fit for an investor.

Analyze stocks like Pepsi & Coca-Cola quicker with TIKR >>>

Limitations of the EV/EBIT Ratio

While EV/EBIT is a powerful tool, it has limitations:

- It does not account for non-operating income or one-time gains/losses.

- It may not be suitable for companies with significant non-operating income or high non-cash expenses.

Investors should use EV/EBIT in conjunction with other metrics to make a well-rounded investment decision.

Which Valuation Metric is Best?

Investors can use many different valuation multiples, such as EV/Revenue, EV/EBITDA, EV/EBIT, or the P/E ratio.

It can be confusing to keep all these metrics straight and to determine which ratios are best for different circumstances.

One helpful trick to know when to use these ratios is to use different ratios depending on the business’s bottom-line earnings consistency:

- Companies with poor bottom-line earnings consistency, such as high-growth start-ups, unprofitable companies, or businesses in cyclical industries, should use metrics like EV/Revenue or EV/EBITDA that focus on figures higher on the Income Statement. These businesses tend to have more stable top-line revenue than bottom-line profit, so it makes sense to use valuation ratios focusing more on a company’s top-line. Startups, unprofitable companies, and cyclical companies often report negative earnings, making ratios like EV/EBIT and P/E that focus on earnings less relevant.

- Companies with strong bottom-line earnings consistency, such as mature businesses in stable industries, with stable margins, or with strong, consistent cash flows, should use metrics like EV/EBIT or the P/E ratio because these figures focus more on bottom-line profitability. Ultimately, investors want to value a business based on the earnings and cash flow the business produces. Since these mature companies report stable earnings, focusing on metrics that use the company’s bottom-line profits makes sense.

EV/EBIT vs. P/E Ratio (Price-to-Earnings)

Unlike the P/E Ratio, which only considers a company’s equity value, EV/EBIT considers the company’s total enterprise value, providing a more holistic view of what investors are paying for the business.

Additionally, EV/EBIT excludes a business’s interest expenses and taxes, which are included in the P/E ratio and can make it more erratic. Long-term investors often prefer EV/EBIT when comparing companies with different debt levels, as it offers a clearer picture of a company’s overall valuation.

EV/EBIT vs. EV/EBITDA

While EV/EBIT and EV/EBITDA measure a company’s valuation, EBITDA excludes depreciation and amortization. For capital-intensive industries like energy, utilities, or telecom, EBITDA may inflate a company’s profitability because it doesn’t account for the capital investments these companies need to make. Long-term investors should use EV/EBIT to avoid overestimating companies with high capital expenditures.

FAQ Section

What is the EV/EBIT ratio and why is it important?

The EV/EBIT ratio compares a company’s enterprise value (EV) to its earnings before interest and taxes (EBIT). It is a useful metric for assessing a company’s valuation relative to its operating performance, helping investors evaluate whether a stock is overvalued or undervalued.

How is the EV/EBIT ratio calculated?

The EV/EBIT ratio is calculated by dividing a company’s enterprise value (EV) by its earnings before interest and taxes (EBIT). The formula is:

EV/EBIT = Enterprise Value / EBIT

This ratio helps investors assess how much they are paying for each dollar of operating earnings.

What does a high EV/EBIT ratio indicate?

A high EV/EBIT ratio suggests that a company might be overvalued compared to its earnings, indicating that investors are paying a premium for the company’s operating performance. However, this can also be a sign of high growth expectations for the company.

How can the EV/EBIT ratio be used in valuation?

The EV/EBIT ratio is often used as a comparative valuation tool to assess companies within the same industry or sector. A lower EV/EBIT ratio may indicate a potentially undervalued stock, while a higher ratio could suggest overvaluation, helping investors identify attractive investment opportunities.

What are the benefits of using the EV/EBIT ratio?

The EV/EBIT ratio provides a more comprehensive valuation than traditional price-to-earnings ratios by accounting for both debt and equity in the enterprise value. It is particularly useful for comparing companies with different capital structures, as it focuses on operating performance rather than net income.

TIKR Takeaway

The EV/EBIT ratio is a powerful tool for helping investors find undervalued stocks and compare their valuations.

EV/EBIT incorporates a business’s full purchase price compared to its earnings before interest and taxes, making it one of the most complete ratios for investors to use.

The TIKR Terminal offers industry-leading financial data on over 100,000 stocks, so if you’re looking to find the best stocks to buy for your portfolio, you’ll want to use TIKR!

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. We aim to provide informative and engaging analysis to help empower individuals to make their own investment decisions. Neither TIKR nor our authors hold positions in any of the stocks mentioned in this article. Thank you for reading, and happy investing!