What is Revenue Growth, and Why Does It Matter?

Revenue growth is an increase in a company’s sales, and is one of the key drivers of a company’s shareholder returns over time.

It helps to indicate demand for a company’s products or services, reflects competitive positioning, and signals the potential for sustainable earnings growth.

Why Does Revenue Growth Matter?

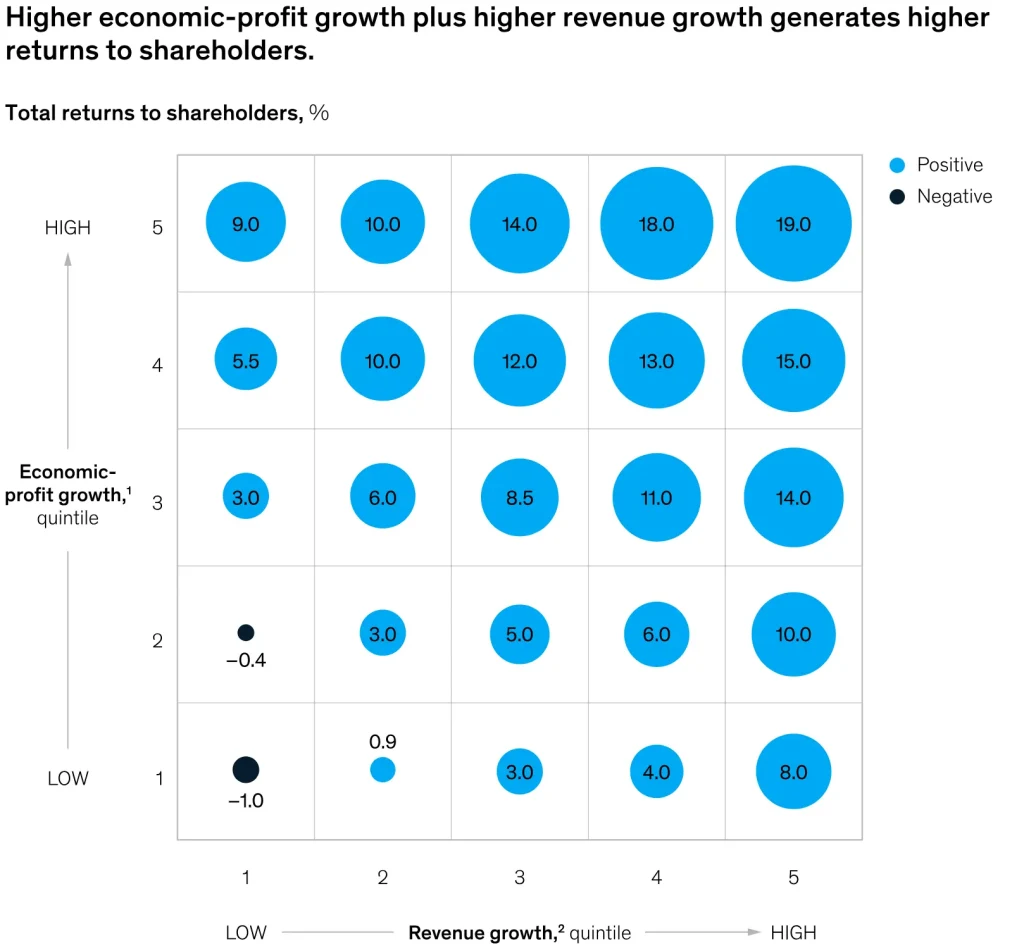

A McKinsey study found that revenue and economic profit growth positively correlate with delivering higher long-term total shareholder returns.

That means that stocks seeing revenue growth are more likely to deliver high returns over time.

Additionally, revenue growth often leads to higher earnings-per-share (EPS) because EPS growth is driven by revenue growth, margin expansion, and inadvertently through share buybacks.

Analyze a stock’s key metrics (like revenue growth) quicker with TIKR >>>

Key Drivers of Revenue Growth

Revenue growth is driven by two primary elements:

- Volume Growth (Units/Services Sold): Expanding the number of units sold directly drives revenue growth.

- Price Increases (Price per Unit): Raising prices per unit sold can increase revenue if customers remain willing to pay without significant demand reduction.

Long-term investors often look for companies that grow revenue through both elements, creating resilient revenue growth that drives value over the years.

How do price increases impact revenue growth?

While volume growth expands the customer base by selling more units, price increases can also drive revenue. When a company raises its prices, the extra money it makes trickles down directly to the company’s bottom line as profit. However, price hikes come with risks, as pushing prices too high can reduce demand.

Pricing power is a company’s ability to raise prices without significantly reducing customer demand. This is valuable because, during periods of rising costs, the business can raise its prices and maintain the same level of profitability.

Find stocks with high-revenue growth and blue-chip business models with TIKR >>>

Key Drivers of Volume Growth

Volume growth, or increasing unit sales, is a fancy way to say that a company sells more stuff. When companies sell more stuff, it generally means the business is growing and doing good things for shareholders.

Volume growth can be achieved through several approaches, such as market share expansion, new market entry, customer retention, upselling, and product innovation. Each offers unique revenue expansion opportunities.

Market Share Growth

Companies can grow volume within their existing markets by increasing their market share. This approach involves capturing customers from competitors or tapping into unmet demand.

Example:

Netflix’s (NFLX) focus on exclusive content allowed it to capture a larger share of the streaming market. For investors, this growth in market share increased Netflix’s revenue and strengthened its position in the global streaming industry.

New Market Entry

Companies often enter new geographic regions or demographic segments to access fresh customer bases. Additionally, this strategy broadens a company’s revenue base and provides diversification, which can be especially helpful if management wants to reduce its reliance on its core business segment.

Example:

Tesla’s (TSLA) entry into China, the largest automotive market globally, enabled it to grow sales significantly. For investors, this move increased Tesla’s revenue and positioned it for continued global growth, thus strengthening its appeal as a long-term investment.

Customer Retention

Retaining existing customers helps a company with revenue stability and growth, especially for companies with subscription or recurring revenue models. High retention rates reduce customer churn, increasing the lifetime value of each customer.

Example:

Microsoft’s (MSFT) high customer retention rates for products like Office 365 create a stable revenue base. For investors, Microsoft’s ability to retain customers provides predictable, recurring revenue that supports long-term growth.

Expansion through Upselling and Cross-Selling

Companies can increase revenue by selling more to existing customers. This strategy might involve upselling premium versions, cross-selling complementary products, or offering additional services.

Example:

Amazon’s (AMZN) strategy of promoting its Prime membership to existing customers increases their spending on the platform. For investors, Amazon’s focus on upselling and cross-selling drives revenue growth by encouraging loyal customers to spend more.

New Products

Introducing new products or services enables companies to create additional revenue streams and diversify their offerings. This approach not only increases revenue but also strengthens brand loyalty, making it a valuable strategy for sustainable growth.

Example:

Apple’s (AAPL) introduction of products like AirPods and the Apple Watch created new revenue streams. For investors, Apple’s continuous product innovation attracts new customers and increases spending from existing ones.

Strategies to Evaluate High-Growth Companies

Companies that can sustain a high revenue growth rate for a long time have a chance of becoming multi-bagger stocks. Here are some strategies to assess a company’s potential revenue growth:

- Total Addressable Market (TAM): Understanding the company’s TAM helps an investor assess a business’s future growth potential. Companies with a large, untapped market have more room to grow their revenue.

- Management’s Strategy: A company’s approach to expanding market share, entering new markets, and innovating can help to assess long-term revenue growth potential.

- Financial Metrics: It’s important to look at key indicators, including Year-over-Year (YoY) revenue growth, customer acquisition costs (CAC), and retention rates. (See how to analyze a stock’s income statement in under 5 minutes.) These metrics reveal the quality and sustainability of the company’s revenue growth.

Example:

Adobe’s (ADBE) transition to a subscription model for products like Creative Cloud increased customer retention and created a steady stream of recurring revenue. For investors, Adobe’s shift strengthened its revenue base and positioned it for consistent long-term growth.

Analyze stocks quicker with TIKR >>>

FAQ Section

What is revenue growth?

Revenue growth refers to the increase in a company’s sales over a specific period. It is typically measured on a year-over-year or quarter-over-quarter basis.

Why is revenue growth important to investors?

Revenue growth is important to investors because it signals a company’s ability to expand its business and gain market share. Consistent growth can support higher earnings and long-term value creation.

What are the key drivers of revenue growth?

The key drivers of revenue growth include increased sales volume, pricing power, product innovation, market expansion, and acquisitions. These factors can vary by industry and business model.

How is revenue growth measured?

Revenue growth is measured by comparing a company’s current revenue to revenue from a previous period. The formula is:

[(Current Period Revenue – Prior Period Revenue) / Prior Period Revenue] × 100

Can a company have strong revenue growth but weak profitability?

Yes, a company can grow revenue rapidly while still generating low or negative profits. This often occurs when high investment in growth strategies outpaces improvements in operating efficiency.

TIKR Takeaway

Revenue growth enables a company to expand, improve profitability, and deliver long-term value to shareholders.

Volume growth (selling more stuff) and price increases are the primary drivers behind sustainable revenue growth for a company.

The TIKR Terminal offers industry-leading financial data on over 100,000 stocks, so if you’re looking to find the best stocks to buy for your portfolio, you’ll want to use TIKR!

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. We aim to provide informative and engaging analysis to help empower individuals to make their own investment decisions. Neither TIKR nor our authors hold positions in any of the stocks mentioned in this article. Thank you for reading, and happy investing!