Real estate has been one of the greatest asset classes for wealth creation in history, and investing in Real Estate Investment Trusts (REITs) can allow you to get all the benefits of investing in real estate without going through the hassles that come with direct property ownership.

In addition, owning REITs is one of the best ways to diversify your portfolio because each REIT effectively owns hundreds of income-generating properties.

What Are REITs, and Why Should You Invest in Them?

REITs are companies that invest in residential and commercial income-generating properties. Investors who buy REITs indirectly invest in the real estate that these REITs own.

Investing in REITs offers several benefits, including:

- Competitive returns: REITs must distribute at least 90% of their taxable income to shareholders in the form of dividends, which often means they pay higher dividends than other stocks.

- Portfolio diversification: By investing in REITs along with other investment securities, you’ll reduce your overall portfolio risk.

- Accessible: With REITs, you don’t need to save thousands of dollars like you would for a down payment on an investment property. Most brokers will let you buy fractional shares of REITs, so you can invest as much or as little as you’d like.

- Liquidity: Unlike traditional real estate investments that can take several months to buy or sell a property, you can buy and sell REITs instantly with just a few clicks.

But with so many REITs out there, it can be challenging to determine which REITs are worth investing in.

That’s why it’s important to understand the critical metrics that drive REITs’ performance and profitability, so you can evaluate REITs and invest in ones that look right for you.

The 6 Most Important Metrics for REIT Investing

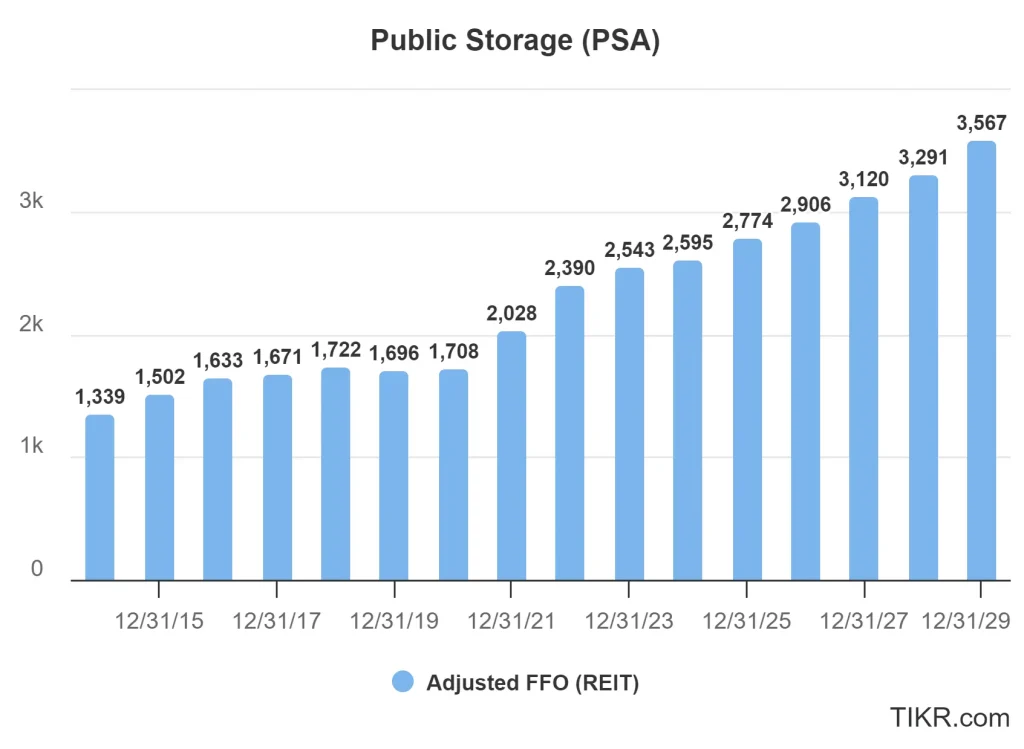

We’ll look at these 6 metrics for some REITs in the self-storage space, like Public Storage (PSA) and Extra Space Storage (EXR).

1. Funds from Operations (FFO)

REITs work a little differently than normal stocks. While most stocks track their earnings through measures like operating income or net income, REITs use Funds from Operations (FFO).

As the name suggests, FFO measures cash flow generated by a REIT from its operations. The National Association of Real Estate Investment Trusts (NAREIT) originally introduced it as a non-GAAP measure.

FFO = Net Income + Depreciation + Amortization + Losses from Property Sales – Gains from Property Sales – Interest Income

The FFO takes into account net income, depreciation, amortization, and losses from the sale of properties, then subtracts any gains from property sales and any interest income.

Tracking FFO gives investors and analysts insights into a REIT’s operating performance and capacity to pay dividends. This makes FFO a widely used and important metric for analyzing and comparing the profitability and efficiency of different REITs.

Analyze REITs quicker with TIKR >>>

2. Adjusted Funds from Operations (AFFO)

AFFO is a more advanced alternative for FFO. AFFO takes the standard FFO further by adjusting for one-time items as well as recurring capital expenditures and other maintenance costs necessary to keep the REIT’s properties in good condition and is generally considered a better measure of a REITs financial performance.

AFFO = FFO + One Time Unusual Items – Recurring Capital Expenditures – Straight Lined Rents

While FFO gives a snapshot of the cash generated from a REIT’s core operations, AFFO provides a more accurate picture of the money available for distribution to investors, a REIT’s financial health, and its ability to sustain dividend payments over the long term by factoring in these ongoing costs.

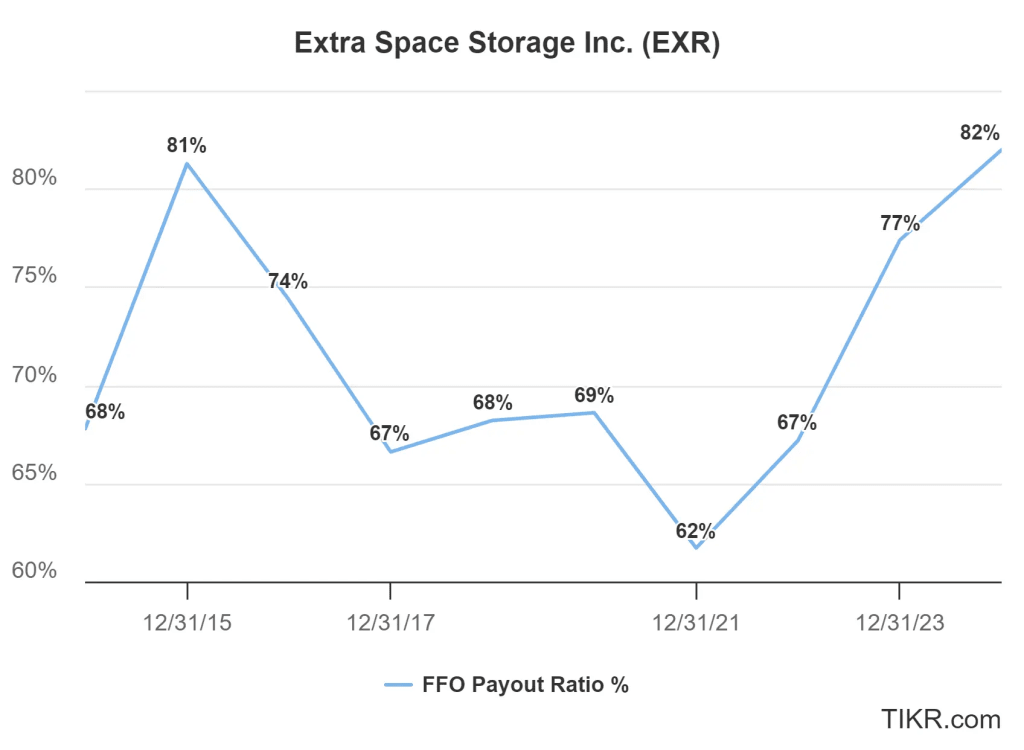

3. Payout Ratio

The FFO payout ratio is the percentage of a REIT’s income paid out to shareholders through dividends.

REITs are a special type of investment class because they must distribute at least 90% of taxable income to shareholders as dividends. Because of this, REITs are naturally going to have a higher payout ratio than most stocks.

While REITs often have higher-than-average payout ratios, if a REIT has a payout ratio near or over 100%, it might suggest that the REIT has little room to manage unexpected expenses or invest in future growth, which might make the REIT’s dividend risky.

On the other hand, a lower payout ratio indicates that the REIT retains more earnings for reinvestment or to cushion against downturns, which could make the REIT financially stronger but also result in lower returns for shareholders.

Overall, the payout ratio helps investors gauge the sustainability of a REIT’s dividend payments and its financial health.

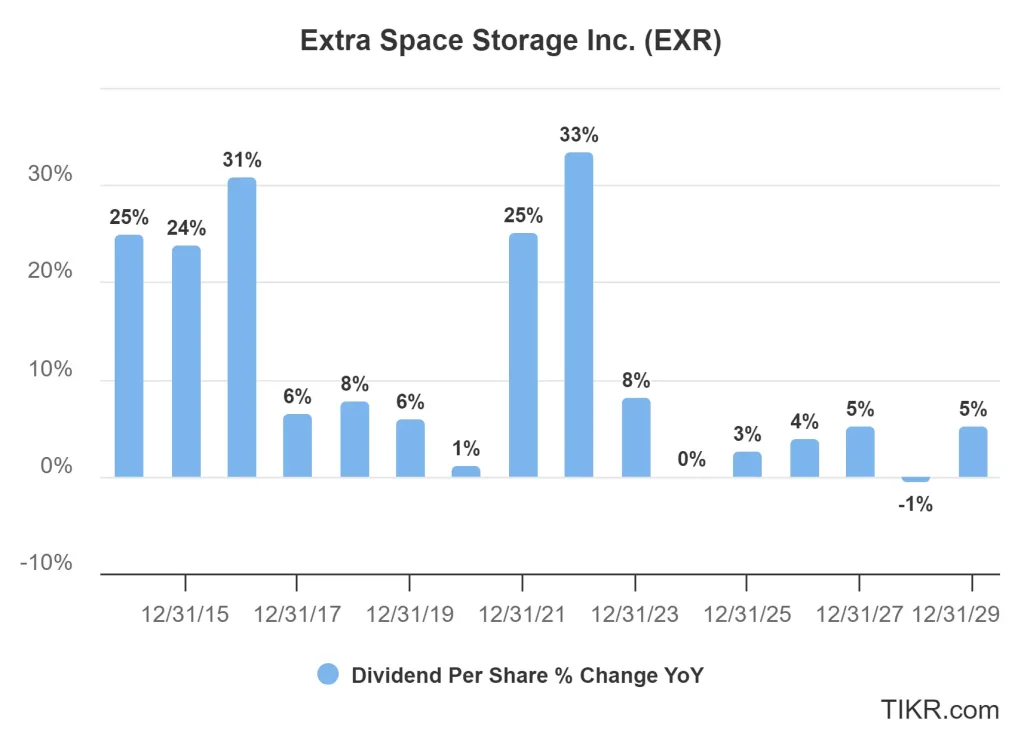

4. Dividend Growth

Dividend growth measures the annual increase in dividends paid to shareholders over time. This growth is a positive indicator of a REIT’s financial health and operational success.

You can see that Extra Space Storage has grown its dividend consistently each year, with some years seeing 20%+ annual growth, and others seeing low single-digit growth.

Consistent dividend growth is a good sign for REITs because it suggests that the REIT effectively manages its properties, generates increasing income, and successfully reinvests profits.

Find the best REITs to buy today with TIKR >>>

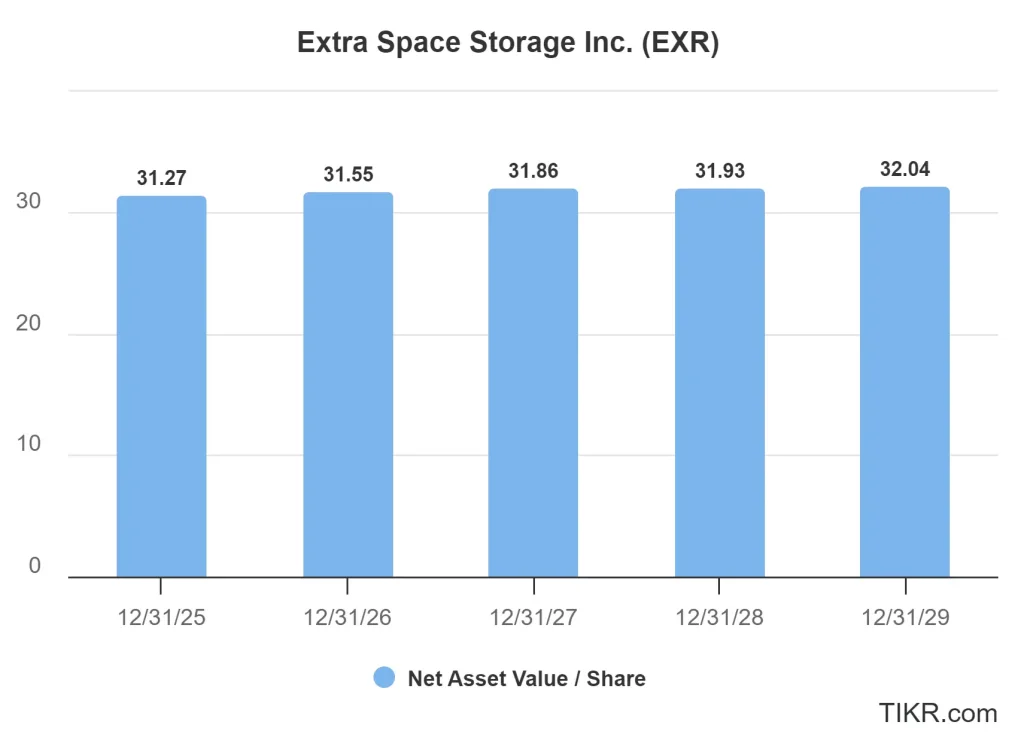

5. Net Asset Value

Net asset value (NAV) is the total value of the REIT’s assets minus its liabilities. NAV affects REITs by serving as a benchmark for valuation. Changes in NAV also reflect the performance and growth of the REIT’s asset portfolio, influencing investment decisions. This is very important in real estate investing because it shows the ultimate value of the real estate holdings.

You can then use the net asset value per share (NAV/Shares Outstanding) to get an idea of what each underlying share is worth and value shares appropriately.

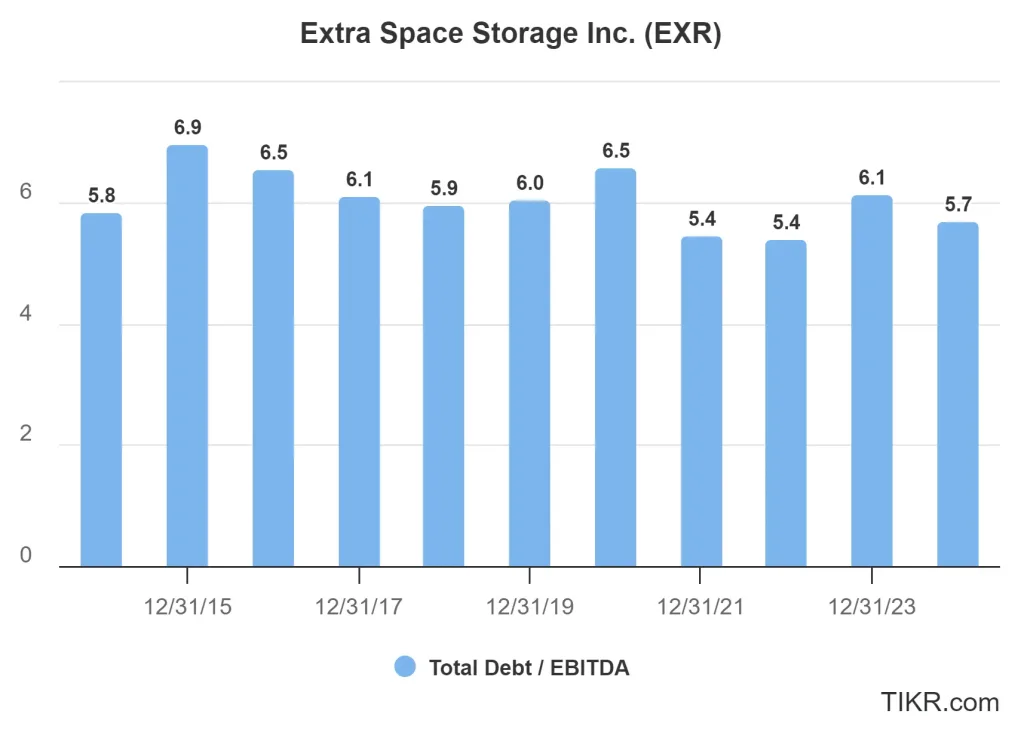

6. Debt-to-EBITDA

Debt-to-EBITDA is another metric used to assess a REIT’s leverage and ability to pay off debt. It is calculated by dividing the REIT’s total debt by its earnings before interest, taxes, depreciation, and amortization (EBITDA).

This ratio indicates how long it would take for the REIT to repay its debt using its current EBITDA. A lower debt-to-EBITDA ratio suggests better financial health and a stronger capacity to manage debt, while a higher ratio indicates higher leverage and potentially greater financial risk.

Factors to Consider When Evaluating REITs

In addition to the key metrics above, there are several factors you should consider when evaluating REITs:

Property Type and Location

Different property types have different returns and risks. For instance, commercial properties have higher returns but are more sensitive to economic downturns. Conversely, residential properties may offer stable rental income but lower growth potential.

Location may also impact a REIT’s returns. Properties in prime areas have higher growth potential but may be pricey, while those in less prime areas might offer low growth potential.

That’s why it’s important to consider the property type and location of a REIT’s properties and whether they align with your investment goals and risk tolerance.

Regulatory Environment

Local and national regulations, including tax policies, can affect REIT operations and profitability. As an investor, you should know the regulatory environment and how it may affect a REIT’s performance. For instance, changes to tax laws may impact the REIT’s ability to distribute dividends to shareholders.

Management Quality

A REIT’s management quality significantly affects its performance. You can evaluate a management team by looking at its track record of successful investments, and its history of creating value for shareholders.

Track top investors’ holdings with TIKR >>>

Occupancy Rates

The occupancy rate is the percentage of occupied properties at a given time. A high occupancy rate suggests a strong demand for the properties, leading to stable rental income, while a low occupancy rate indicates that a REIT has difficulty attracting tenants and, thus, unreliable income.

Make sure you’re looking for REITs that have a track record of getting properties with strong occupancy rates.

Credit Rating

You should also look at a REIT’s credit rating, as it indicates a company’s financial health. A good credit rating means that the REIT can borrow money on favorable terms. It’s always a good idea to look for REITs with investment-grade credit ratings.

Macroeconomic Factors

Economic conditions, such as interest rates and market trends, influence REIT performance. Favorable economic environments can enhance REIT profitability, while adverse conditions may pose risks.

FAQ Section

What are the most important metrics for analyzing a REIT?

The most important metrics for analyzing a REIT include Funds From Operations (FFO), Adjusted Funds From Operations (AFFO), payout ratio, dividend growth, Net Asset Value, and Debt-to-EBITDA. These help investors understand a REIT’s profitability, payout capacity, and financial stability.

Why is Funds From Operations (FFO) used instead of earnings for REITs?

Funds From Operations (FFO) is used instead of traditional earnings because it adds back non-cash expenses like depreciation, which can distort a REIT’s true operating performance. Since real estate assets often appreciate in value, FFO gives a more accurate picture of cash flow available for dividends.

What does Adjusted Funds From Operations (AFFO) tell investors?

Adjusted Funds From Operations (AFFO) refines FFO by subtracting recurring capital expenditures and maintenance costs, giving investors a better view of the sustainable cash flow available to support dividend payments.

How does the cap rate help evaluate a REIT’s portfolio?

The capitalization rate (cap rate) measures a property’s net operating income as a percentage of its market value. It helps investors assess whether a REIT’s properties are delivering attractive returns relative to their price.

Why is the occupancy rate important for REITs?

The occupancy rate tells investors how much of a REIT’s property space is currently generating rental income. Higher occupancy rates typically indicate stronger revenue and more efficient property utilization.

TIKR Takeaway:

REITs can be a great way to get the benefits of investing in real estate without the hassles of direct property ownership. With the key metrics discussed above, you’ll know what to look for when finding the best REITs to invest in.

The TIKR Terminal offers industry-leading financial information on over 100,000 stocks, helping you find the best dividend growth stocks today.

TIKR offers institutional-quality research with a simple platform made for individual investors like you.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. Our analysis might not include recent company news or important updates. TIKR has no position in any stocks mentioned. Thank you for reading, and happy investing!