Amazon’s story began in 1994 when Jeff Bezos had a simple yet ambitious idea: an online marketplace for books.

Over the course of decades, Amazon grew from selling books to operating successful business units across many industries.

What’s most important about this remarkable journey is that while Amazon’s team has done the hard work of growing the company, thousands of investors have created wealth passively by simply holding $AMZN shares and riding along with Amazon’s success.

This article is going to break down who owns Amazon.

Who are Amazon’s Top Shareholders?:

Top individual investors who own Amazon are:

- Jeff Bezos (Amazon’s founder and the company’s largest shareholder)

- Andrew Jassy (Amazon’s CEO)

- Douglas Herrington

Some of the top institutional investors that own Amazon on behalf of its clients are:

- Vanguard

- BlackRock (the world’s largest asset manager)

- State Street

- Fidelity

- Geode Capital Management

And some of the top hedge funds trying to achieve outsized returns holding Amazon are:

- Skye Global Management (47.2% of this fund’s $4.5B portfolio is invested in Amazon – talk about high conviction!)

- Adage Capital Management

- Coatue Management

- Berkshire Hathaway (only 0.5% of Berkshire’s portfolio, still a small position)

- Millennium Management

Who are Amazon’s top individual investors?

- Jeff Bezos: Owns 928,433,873 Amazon shares worth $180.6 billion, which is 8.9% of Amazon’s outstanding shares. Jeff Bezos is Amazon’s founder and was Amazon’s CEO until July of 2021, when he transitioned to Executive Chairman of Amazon. Bezos remains Amazon’s largest stakeholder. Bezos recently sold 8,241,406, or 0.88%, of his total Amazon shares.

- Andrew Jassy: Owns 2,100,742 Amazon shares worth $408.6 billion, which is 0.02% of Amazon’s outstanding shares. Andrew Jassy was promoted from within the company to CEO in July of 2021 when Jeff Bezos stepped down from the CEO role. Jassy joined Amazon in 1997 and is credited with founding and leading Amazon Web Services (AWS), Amazon’s highly successful cloud computing division, which has become one of Amazon’s major revenue drivers. Jassy recently added 31,176 Amazon shares, increasing his position by 1.51%.

- Douglas Herrington: Owns 513,817 Amazon shares worth $99.9 million, which is 0.00% of Amazon’s outstanding shares. Douglas Herrington is the CEO of Worldwide Amazon Stores, formerly known as Amazon’s Consumer business, where Herrington oversees Amazon’s retail operations. Herrington joined Amazon in 2005 and has held various leadership roles, including leading the North American Consumer business and working on Amazon’s Prime and Grocery divisions. Herrington recently sold 16,000, or 3.02%, of his total Amazon shares.

Who are Amazon’s top institutional investors?

See Amazon’s full list of institutional investors >>>

- Vanguard Group: Owns 781,863,009 Amazon shares worth $152.1 billion, which is 7.5% of Amazon’s outstanding shares. Vanguard is a leading asset management firm with over $7.2 trillion in AUM known for its low-cost index funds and ETFs. Amazon makes up 1.97% of Vanguard’s holdings, and Vanguard recently increased its position by 1.93%.

- BlackRock: Owns 407,999,117 Amazon shares worth $73.6 billion, which is 3.9% of Amazon’s outstanding shares. BlackRock is based in New York City and is the largest institutional money manager globally, with more than $9.4 trillion in assets under management. BlackRock owns iShares, the world’s leading exchange-traded funds (ETF) provider. Amazon makes up 1.95% of BlackRock’s Institutional Trust Company’s holdings, and BlackRock recently increased its position by 1.58%.

- State Street: Owns 351,606,995 Amazon shares worth $68.4 billion, or 3.38% of Amazon’s total outstanding shares. State Street Corporation is a global financial services company with $3.7 trillion in AUM. It’s the creator of the first ETF, the SPDR S&P 500 ETF Trust, and owns the SPDR ETF line. Amazon makes up 2.70% of State Street Global Advisor’s total holdings, and State Street recently increased its position by 2.01%.

- Fidelity: Owns 312,169,562 Amazon shares worth $56.3 billion, or 3.00% of Amazon’s total outstanding shares. Fidelity Investments is a diversified financial services company with $4.4 trillion in assets under management. Fidelity is best known for its actively managed mutual funds and customer-centric approach. Amazon makes up 2.61% of Fidelity Management & Research Company’s total holdings, and Fidelity recently increased its position by 2.54%.

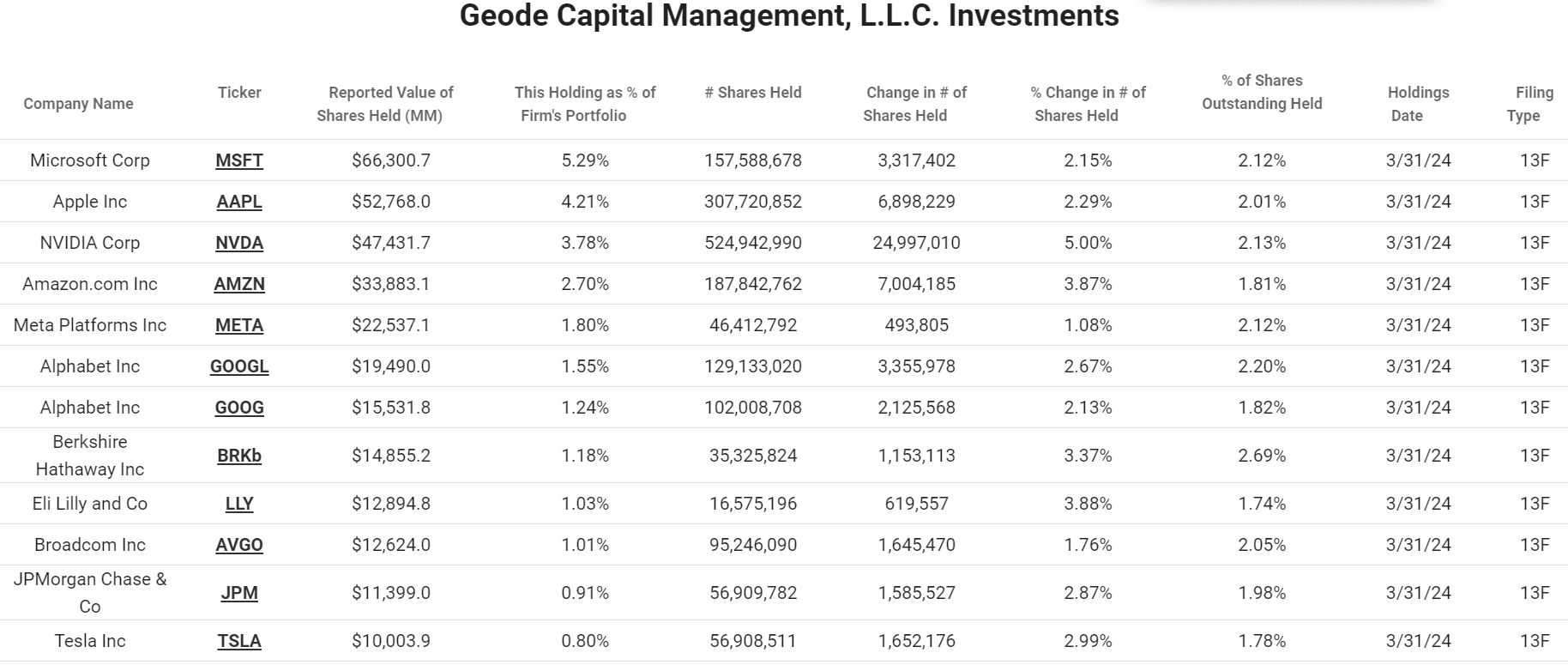

- Geode Capital Management: Owns 187,842,762 Amazon shares worth $33.8 billion, or 1.81% of Amazon’s total outstanding shares. Geode Capital Management is a Boston-based asset management firm with over $1.2 trillion in AUM specializing in systematic, quantitative investment strategies. Geode also manages a substantial portion of Fidelity’s index fund assets, focusing on delivering consistent, risk-adjusted returns. Amazon makes up 2.70% of Geode Capital Management’s total holdings, and Geode recently increased its position by 3.87%.

Who are Amazon’s top hedge fund investors?

See Amazon’s full list of hedge fund investors >>>

- Skye Global Management: Owns 11,020,000 Amazon shares worth $1.99 billion, or 0.11% of Amazon’s total outstanding shares. Amazon makes up an incredible 47.2% of this fund’s holdings. Skye Global Management focuses on a concentrated portfolio of high-conviction, long-term equity investments, primarily in the technology and consumer sectors. Skye recently sold 977,901 shares, or 8.15% of its Amazon shares.

- Adage Capital Management: Owns 10,197,960 Amazon shares worth $1.84 billion, or 0.10% of Amazon’s total outstanding shares. Amazon makes up 3.47% of this fund’s holdings. Adage Capital Management employs a long/short equity strategy, primarily investing in U.S. public equities, with a focus on the healthcare, consumer, and technology sectors. Adage recently purchased 503,300 shares of Amazon, adding 5.19% to its shares.

- Coatue Management: Owns 10,070,576 Amazon shares worth $1.82 billion, or 0.10% of Amazon’s total outstanding shares. Amazon makes up 7.12% of this fund’s holdings. Coatue Management specializes in technology-focused investments, employing a long/short equity strategy and venturing into private equity and venture capital investments. Adage recently purchased 241,514 shares of Amazon, adding 2.46% to its shares.

- Berkshire Hathaway: Owns 10,000,000 shares of Amazon worth $1.94 billion, or 0.10% of Amazon’s outstanding shares. Amazon makes up just 0.51% of Berkshire’s holdings. Berkshire Hathaway, led by Warren Buffett, is known for its value investing approach, focusing on acquiring high-quality companies with strong fundamentals and holding for the long term. Berkshire Hathaway hasn’t purchased or sold any shares of Amazon recently.

- Millennium Management: Owns 9,863,650 Amazon shares worth $1.78 billion, or 0.09% of Amazon’s total outstanding shares. Amazon makes up 1.55% of this fund’s holdings. Millennium Management utilizes a multi-strategy approach, deploying capital across a diverse range of asset classes, geographies, and investment strategies. Millennium recently added a big position with a purchase of 2,390,755 shares of Amazon, which added 31.99% to its position.

Recent Insider Transactions:

Insider Transaction Meaning:

First of all, an insider at a company is either a company officer (think upper management, like a CEO, CFO, COO, etc), someone on the Board of Directors, or somebody who owns over 10% of the company.

Amazon’s insiders include company officers and members of the Board of Directors because nobody owns over 10% of the company.

Insiders are legally required to disclose to the SEC when they buy or sell their company’s stock, which allows savvy investors to track whether the smartest people at a company are buying or selling the stock.

Is insider selling always a bad sign?

Jeff Bezos and other insiders have been selling Amazon.

Does that mean $AMZN is a bad investment?

Not necessarily. Company insiders may sell a stock because they lack confidence in the company or because they think the stock is overvalued, but it’s just as common for insiders to sell their stock for personal reasons or to diversify their portfolio.

As the legendary investor Peter Lynch said: “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

We generally like to look for insider buying, but it’s not always a bad sign if insiders are selling.

Should you only buy stocks with insider buying?

It’s a positive sign to see insiders buying a stock, but it’s certainly not required for investing in a stock.

Remember, tracking insider transactions is just one facet of stock analysis.

Amazon’s Recent Insider Trades:

See all of Amazon’s recent Insider Transactions >>>

- Founder & Executive Chairman | Jeff Bezos: Owns 928,029,899 Amazon shares worth $180.5 billion, which is 8.92% of Amazon’s outstanding shares. Jeff Bezos is Amazon’s founder and was Amazon’s CEO until July of 2021 when he transitioned to the role of Executive Chairman for Amazon. Bezos remains Amazon’s largest stakeholder. Bezos recently sold 8,645,380, or 0.92%, of his total Amazon shares.

- Former CEO of Amazon Web Services | Adam Selipsky: Owns 146,007 Amazon shares worth $25.8 million, which is 0.00% of Amazon’s outstanding shares. Selipsky was the former President and CEO at Tableau, and now the former CEO of Amazon Web Services, as Matt Garman has recently succeeded Selipsky as the CEO of AWS. Selipsky recently purchased 15,424 Amazon shares, adding 11.81%, to his total Amazon holding.

- Senior Vice President | David Zapolsky: Owns 59,500 Amazon shares worth $11.5 million, which is 0.00% of Amazon’s outstanding shares. Zapolsky joined Amazon in 1999 and currently oversees Amazon’s legal, privacy, compliance, and regulatory affairs. Selipsky recently sold 4,710, or 7.34%, of his total Amazon shares.

- CEO of Worldwide Amazon Stores | Douglas Herrington: Owns 513,817 Amazon shares worth $101.5 million, which is 0.00% of Amazon’s outstanding shares. Douglas Herrington is the CEO of Worldwide Amazon Stores, formerly known as Amazon’s Consumer business, where Herrington oversees Amazon’s retail operations. Herrington joined Amazon in 2005 and has held various leadership roles, including leading the North American Consumer business and working on Amazon’s Prime and Grocery divisions. Herrington recently sold 16,000, or 3.02%, of his total Amazon shares.

Recap:

Jeff Bezos (Amazon’s founder and former CEO) has been selling shares, but Adam Selipsky (former CEO of Amazon Web Services) has added 11.8% to his Amazon holdings.

Additionally, Skye Global Management is a $4.5B hedge fund with 47.2% of its assets invested in Amazon.

If you want to be “in the know” about top stocks, you’re going to want to sign up for TIKR.

The TIKR Terminal offers industry-leading investment research on over 100,000 global stocks to help you analyze and find the best stocks for your portfolio.

TIKR is the hottest thing since sidewalks in mid-July – and you can sign up totally free!

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. We aim to provide informative and engaging analysis to help empower individuals to make their own investment decisions. Neither TIKR nor our authors hold positions in any of the stocks mentioned in this article. Thank you for reading, and happy investing!