The past 5 years have been tough for Hormel stock.

Hormel (HRL) shareholders nearly broke even in the past 5 years, collecting $4.89 in dividends over the past 5 fiscal years while the stock fell from $42 to $32/share. This is really poor:

Hormel develops and distributes meat and other food products primarily in the United States.

Even if you don’t know the company, you’ve probably heard of some of the food brands the company owns, like Spam, Planters, Black Label, Jennie-O, Skippy, Wholly Guacamole, Mr. Peanut, and more.

Analysts expect the company can grow revenue and earnings in 2025 and beyond, but analysts still see the stock as fairly valued.

What’s the forecast for HRL stock?

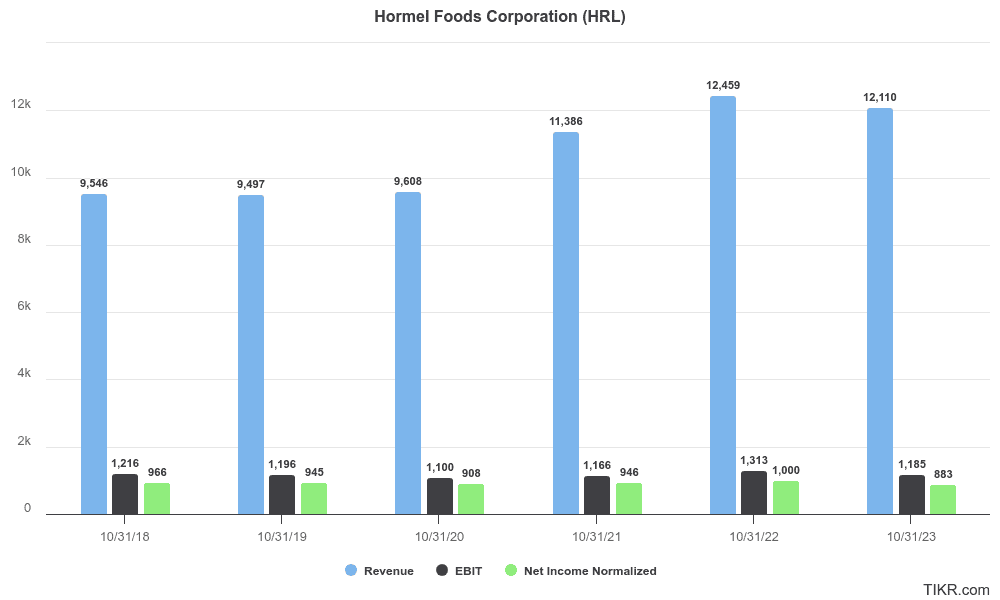

Over the past 5 years, Hormel has seen OK revenue growth, but Hormel has actually become less profitable, with operating income and net income falling:

Notable 5-Year Growth Figures:

- Revenue: 4.9% CAGR (compound annual growth rate)

- Operating Income: -0.5% CAGR (profits fell)

- Net Income: -0.8% CAGR

See HRL’s full financial history >>>

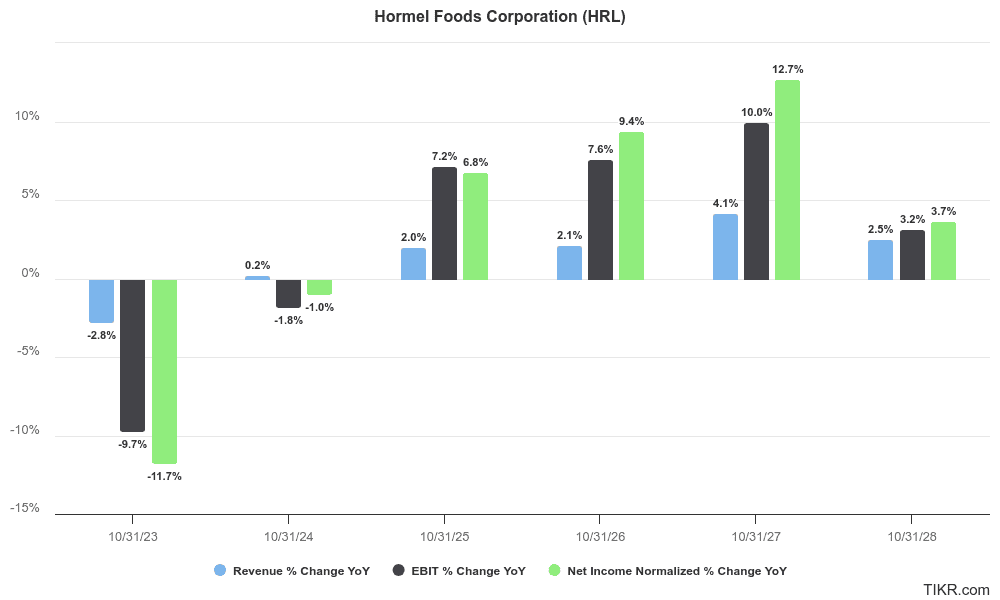

However, analysts expect Hormel to see a slightly brighter future. Analysts expect Hormel to climb back towards previous levels of profitability:

Hormel Company Forecast:

Analysts expect Hormel’s revenue and earnings to see a slight dip in 2024, followed by an increase in revenue and profits in 2025 and beyond:

Notable 3-Year Forecast Figures:

- Revenue: 1.4% CAGR

- Operating Income: 4.2% CAGR

- Net Income: 5.0% CAGR

Notable 5 Year Forecast Figures:

- Revenue: 2.2% CAGR

- Operating Income: 5.1% CAGR

- Net Income: 6.2% CAGR

See HRL’s full analyst estimates >>>

Hormel stock forecast (in plain English)

Hormel is a slow-growing company, and analysts expect the company to continue to grow slowly.

Profits are expected to grow at a decent rate after 2024, but revenue is barely expected to grow.

EPS growth is important for driving shareholder returns. But I’d argue that revenue growth is more important over the long run. There’s a limit to how high a company can increase its earnings if its revenue never grows.

For that reason, Hormel has a weak growth score and a weak forecast score, even though the company is expected to grow earnings rapidly after 2024.

Is Hormel a high-quality business?

You probably hear all the time that a company has a high-quality business model.

But what does that actually mean?

Generally, it means that a company is highly profitable. This signals to investors that the company is most likely serving an untapped market, which makes it easier for the company to drive high shareholder returns.

To see if a company has a high-quality business model, we like to check a company’s:

- ROIC (return on invested capital)

- Gross margins

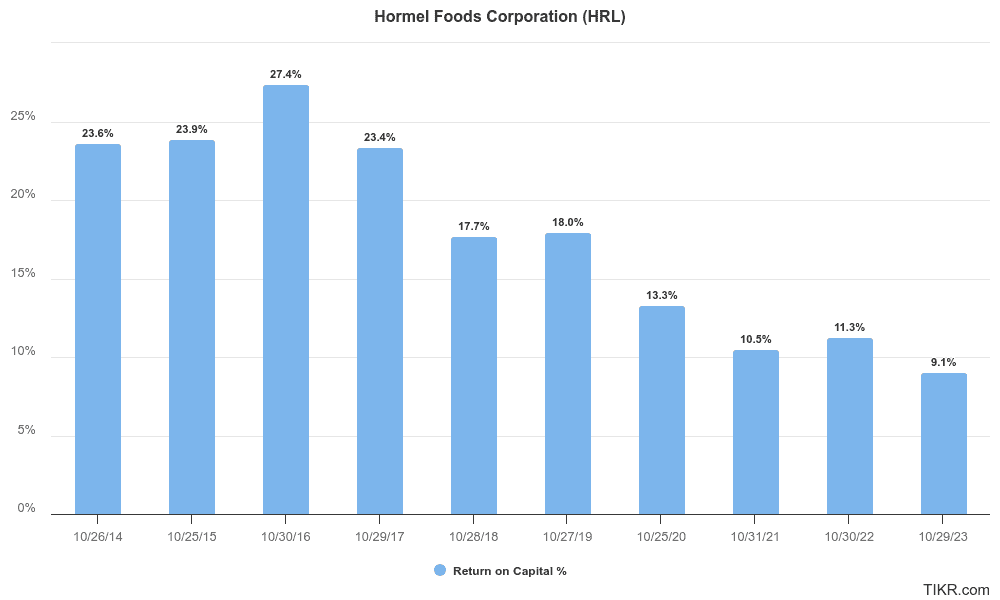

Many investors consider return on invested capital (ROIC) to be the holy grail of profitability measures because it measures the total return that a company makes from the total capital invested in the business.

The formula takes the company’s net operating profit after taxes and divides by the company’s total invested capital, which is the sum of total debt and equity.

Hormel’s return on capital has declined in the past 5 years, falling from 17.7% in 2018 to just 9.1% in the most recent fiscal year. This is not good:

We would ideally like to see a company like Hormel achieving 20% returns on capital to really be an exciting stock. Still, some investors might find consistent, double-digit returns on capital impressive.

With the company’s ROIC hovering around 10% over the past few years, it raises questions about whether Hormel is facing more competition because it isn’t sustaining the profitability that it used to.

Gross Margins

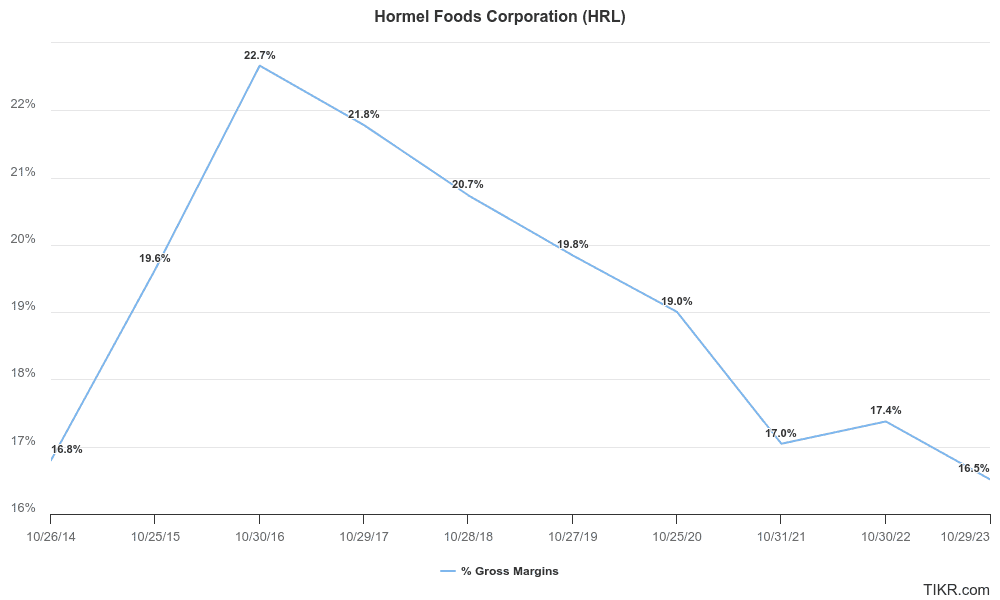

Hormel’s falling ROIC tells the story of a company facing increased competition or an inability to price its products at a premium.

And Hormel’s gross margins tell a similar story.

Gross margins measure the percentage of revenue left over after a company pays its cost of goods sold (COGS), which are the material and service costs directly tied to creating and delivering products or services.

A company with low gross margins generally operates in a commoditized industry, while a business with high gross margins comfortably sells products for much more than they cost to produce.

Hormel has seen gross margins fall from 20.7% in 2018 to just 16.8% in the last 12 months. This is also not good:

Hormel’s gross margins are declining, which means the company’s products might be becoming more commoditized, or the company simply can’t pass along cost inflation to its customers.

As a side note, 16.5% gross margins are quite low. We like to see companies with at least 30% gross margins, but ideally, 50% gross margins or higher. Obviously, not all companies can achieve 50% or even 30% gross margins, but 16.5% gross margins are pretty low.

Check out Hormel’s full profitability analysis >>>

Hormel is financially strong

Fortunately, Hormel has strong financial safety, which is something we look for in any stock we analyze.

The company has a healthy Net Debt/EBITDA of 1.78x. We like to see anything under 3x because this indicates the business doesn’t have too much debt.

Also, Hormel has an interest coverage ratio of 14.4x. This is extremely healthy (anything over 3x is great) and indicates that the business will have no trouble paying its interest expense from its operating profits.

Hormel has a reasonable amount of debt and can comfortably pay the interest on its debt.

Check out Hormel’s full balance sheet analysis >>>

Is Hormel a good dividend stock?

Hormel has an impressive dividend track record. The company has grown dividends to shareholders for 58 consecutive years, making the company a Dividend King.

Only 53 active Dividend Kings exist today, so this is a big deal.

Hormel currently has a 3.5% dividend yield, which is much higher than its 5-year average yield of 2.3%:

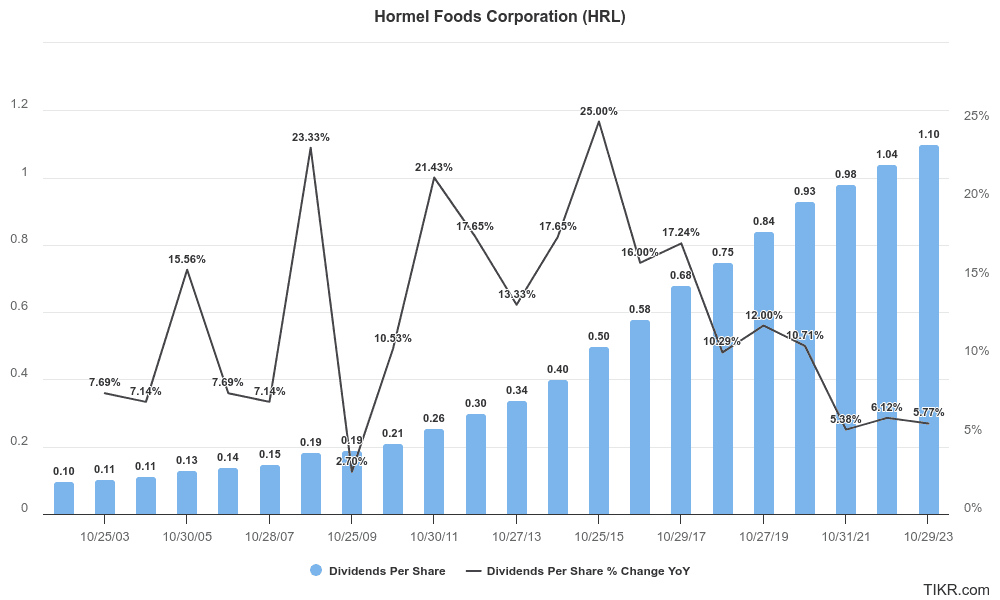

You can see that in the past 5 years, Hormel has grown its annual dividends in the mid-single-digits to low-double-digits:

Generally, dividend investors look for companies that are paying high dividends but also growing their dividends every year.

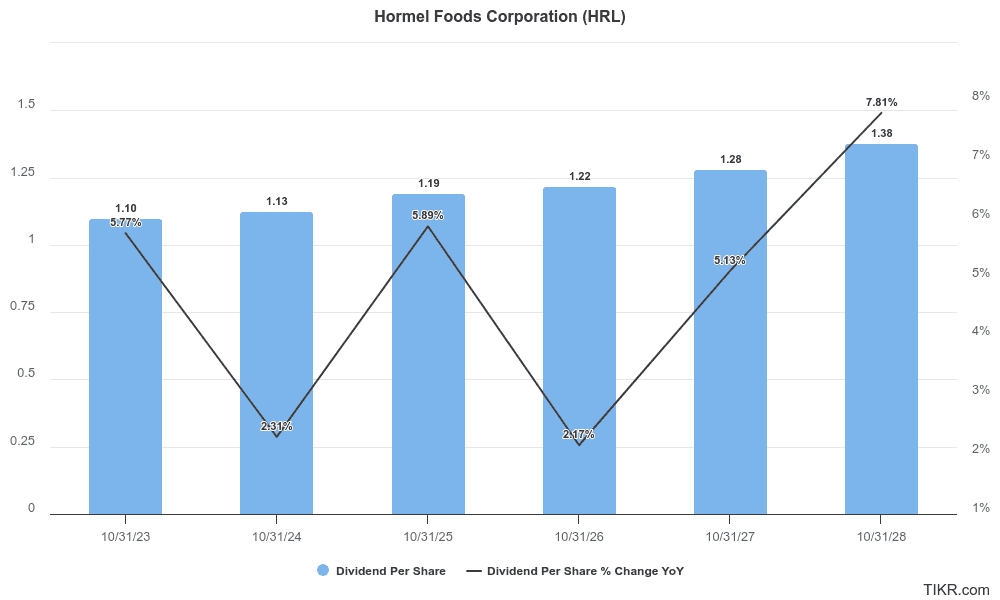

Analysts expect Hormel’s dividend growth to continue.

What is Hormel’s dividend growth rate?

Analysts expect Hormel to grow dividends at a 4.6% CAGR over the next 5 years:

Check out Hormel’s full analyst estimates >>>

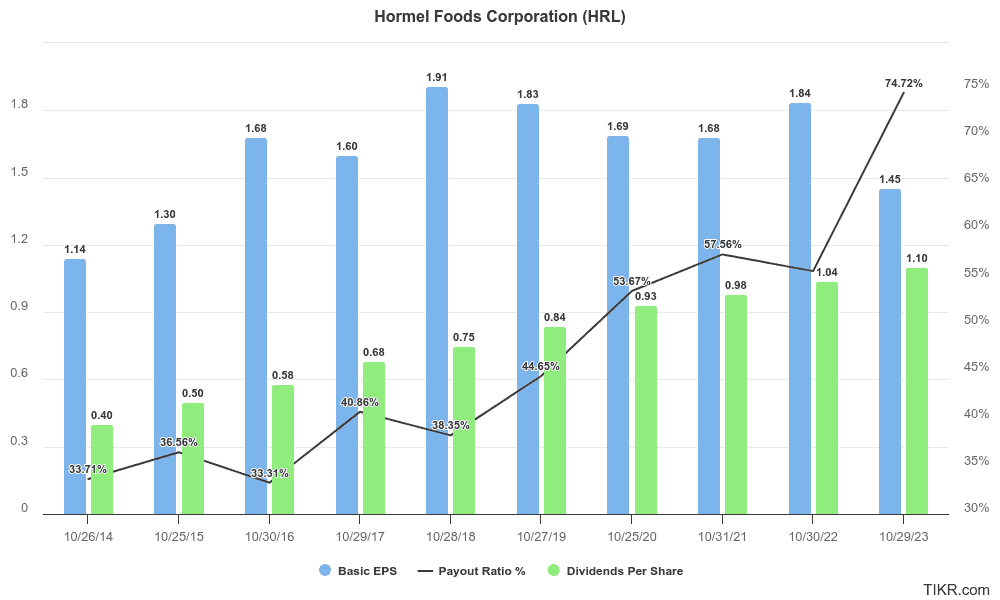

Sometimes, companies with long dividend track records grow their dividends too fast and are forced to reduce or cut their dividends because they’re simply paying out too much of their earnings to investors.

That’s why we check a stock’s payout ratio. We want to make sure that dividend-paying companies like Hormel can comfortably grow dividend payments to shareholders for years to come.

Hormel’s payout ratio has steadily increased in the past 5 years, from 44.7% in 2019 to a 78.9% payout ratio in the last 12 months. This is a little bit concerning:

We generally like to a company’s payout ratio below 70%, so it’s a bit concerning that the LTM payout ratio has reached 78.9%.

Hormel’s dividend outlook (in plain English)

Hormel offers a good dividend. It’s growing, and it’s most likely safe from cuts or reductions.

Hormel has one of the best dividend track records in the world, having increased its dividends for 58 consecutive years. It currently offers a 3.5% dividend yield.

Analysts expect the dividend to grow at a 4.6% CAGR over the next 5 years, which is good because this increases shareholder returns.

Even though the company’s payout ratio has been a bit high, at 78.9% in the last 12 months, we think the dividend is most likely safe from reductions or cuts. Hormel’s earnings are expected to grow in 2025 and beyond, so the earnings rise will help bring the payout ratio down.

Is Hormel undervalued?

At the end of the day, Hormel is a food industry giant and a Dividend King. So, if the stock is undervalued, it might be worthy of your attention.

Today, analysts give $HRL a consensus price target of $31.75. Hormel is trading right around $32 per share, so analysts think the stock is fairly valued.

We aggregate consensus estimates from Wall Street’s sell-side analysts, so real people make these estimates. Of course, analysts get estimates wrong all the time, but checking out the analyst estimates is still a good place to start to see if a stock might be undervalued.

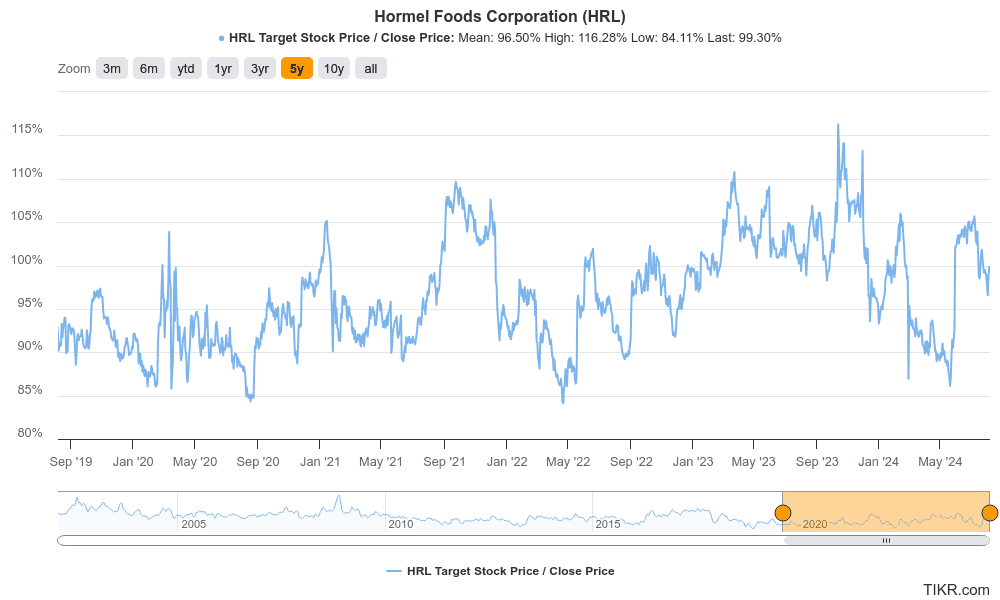

The graph below shows analysts’ target stock price vs. the actual stock price over the last 5 years. Any time the line was over 100%, analysts thought the stock was undervalued:

From the graph, it’s clear that analysts don’t think Hormel has much upside at the stock’s current share price ($32/share).

Still, you might be thinking:

“Maybe the stock is undervalued because Hormel’s stock price is near its 5-year low?“

For this, we’ll look at the company’s NTM P/E ratio. This divides the company’s current share price by analysts’ consensus estimates for its next twelve months earnings per share.

Hormel is trading 19.2% below its 5-year average NTM P/E. This suggests $HRL could be slightly undervalued:

You can see that Hormel is trading near its 5-year low for its P/E ratio.

This doesn’t necessarily mean the stock is undervalued, because Hormel’s earnings and profitability have also declined in the past 5 years.

But if Hormel is able to drive growth in 2025, it could be an interesting time to revisit the stock, if you’re interested in the business.

Check out Hormel’s full valuation analysis >>>

The Takeaway

Hormel is a Dividend King trading near its 5-year low, but analysts see the stock as fairly valued at $32/share.

The company has seen years of declining profitability, but there may be potential for the stock to bounce back if Hormel sees revenue and earnings growth in 2025 and beyond.

The TIKR Terminal offers industry-leading financial data on $HRL and over 100,000 other stocks.

So if you’re looking to analyze and find the best stocks for your portfolio, you’ll want to use TIKR.

TIKR offers institutional-quality research with a simple platform made for individual investors like you.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. We aim to provide informative and engaging analysis to help empower individuals to make their own investment decisions. Neither TIKR nor our authors hold any positions in the stocks mentioned in this article. Thank you for reading, and happy investing!