Key Takeaways:

- The 2-Minute Valuation Model values Nvidia stock at $183/share in 2 years.

- Even though the stock could offer 15.6% annual returns, Nvidia stock could still be risky because growth could slow down more than analysts anticipate due to volatility in AI-driven spending.

- Get accurate financial data on over 100,000 global stocks for free on TIKR >>>

What is the 2-Minute Valuation Model?

There are 3 core factors that drive a stock’s long-term value:

- Revenue Growth: How big the business becomes.

- Margins: How much the business earns in profit.

- Multiple: How much investors are willing to pay for a business’s earnings.

The 2-Minute Valuation Model uses a simple formula to value stocks:

Expected Normalized EPS * Forward P/E ratio = Expected Share Price

Revenue growth and margins drive a company’s long-term normalized EPS, and investors can use a stock’s long-term average P/E multiple to get an idea of how the market values a company.

Why Nvidia Could Be Undervalued

Forecast

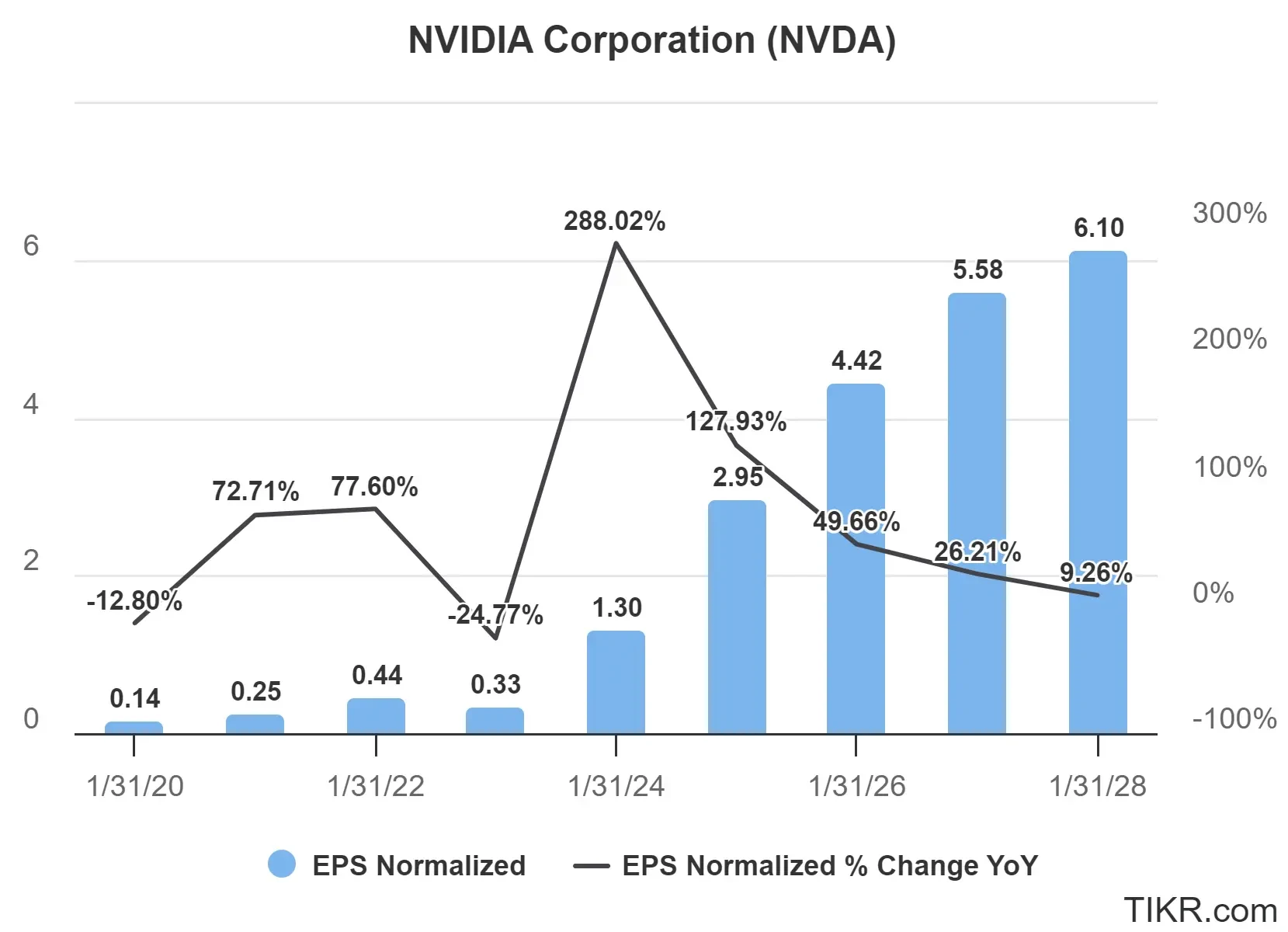

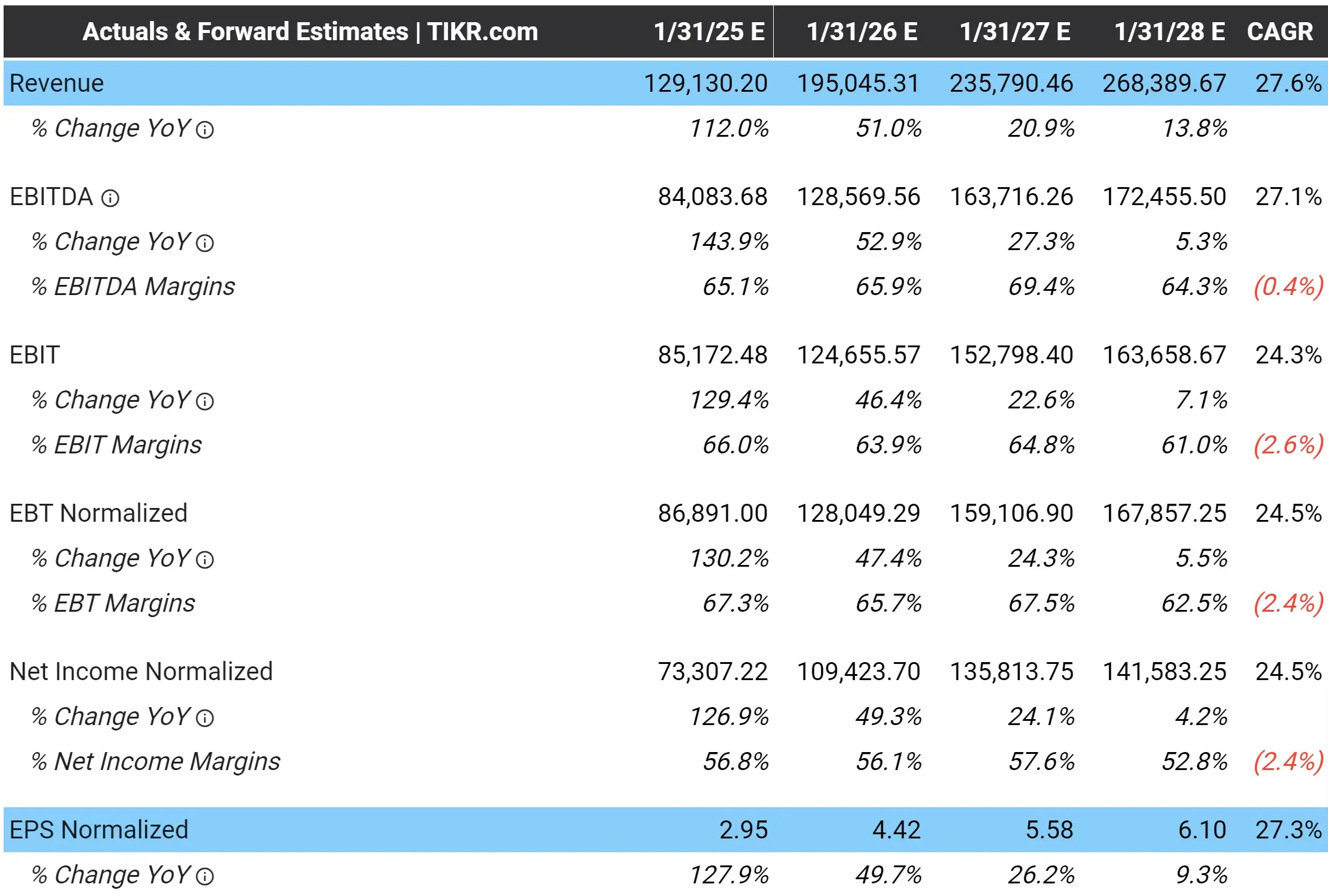

On Nvidia’s Analyst Estimates tab shown below, you can see analysts expect Nvidia to grow revenue at a 27.6% compound annual growth rate over the next 3 years, with normalized earnings per share, or EPS, expected to grow at about the same rate:

View Nvidia’s full analyst estimates >>>

For context, Nvidia’s growth is expected to slow down some going forward because the business exploded over the past 5 years, with revenue growing at 63.7% per year and normalized EPS growing at an 82.7% CAGR.

Valuation Multiple

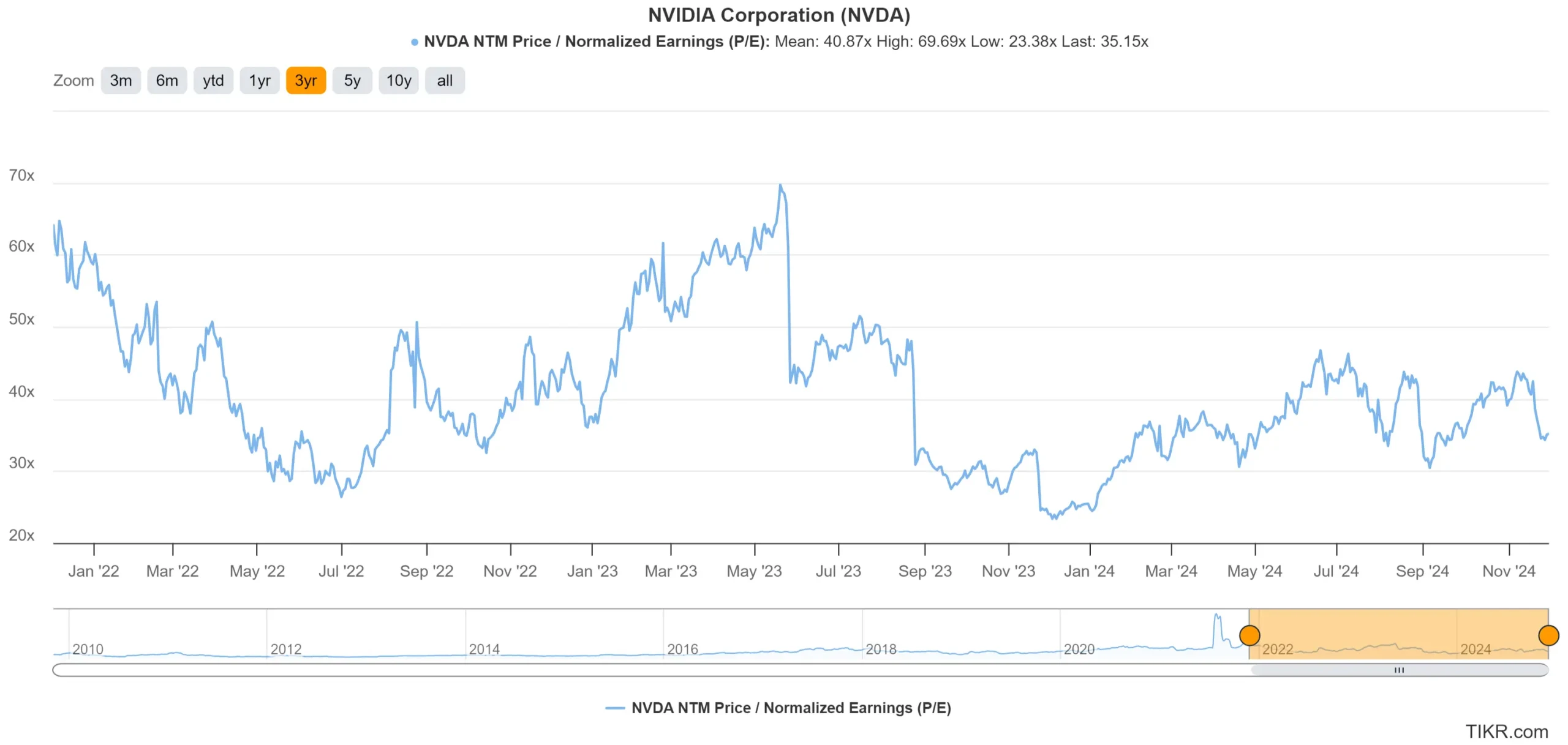

Nvidia currently trades at around $137 per share, which means the stock trades around 19 times next year’s expected revenue and 35 times next year’s expected earnings.

Nvidia averaged a 41x forward P/E multiple over the past 3 years:

Value stocks quicker with TIKR >>>

We’ll use a slightly lower 30x forward P/E multiple in our valuation because Nvidia’s growth is expected to slow down considerably.

Fair Value

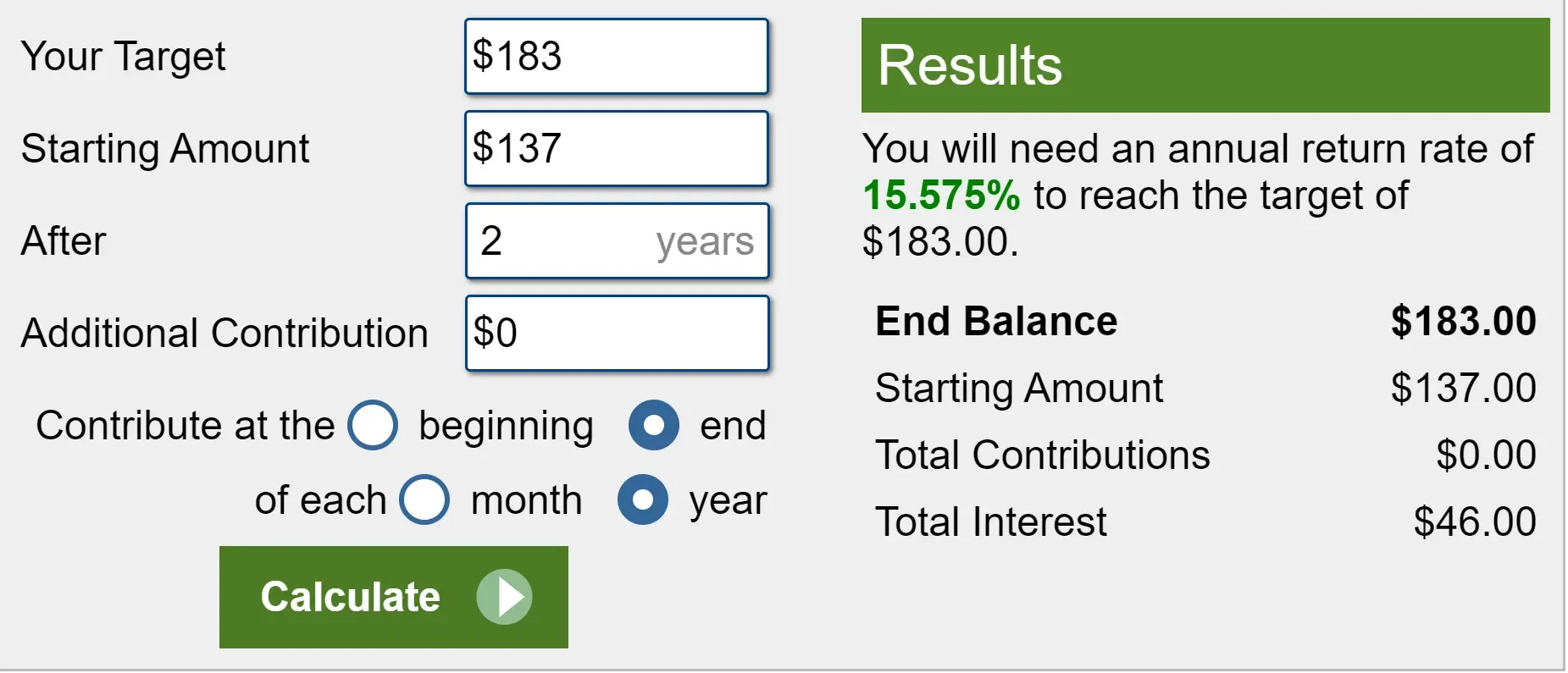

3 years from now, Nvidia is expected to reach about $6.10 in normalized EPS. At a 30x NTM P/E multiple, that values Nvidia stock in 2 years at $183/share.

The NTM P/E multiple uses the next twelve months’ expected earnings, so a 2-year valuation uses 3-year EPS forecast figures.

With the stock trading at about $137 today, this implies that we would get a 15.6% return per year over the next 2 years, or a 34% total return if we bought Nvidia stock today:

This sounds pretty great, but these higher returns might come at a higher risk for investors.

Risks:

Nvidia’s growth could slow down more than analysts anticipate, as AI-driven spending could be volatile.

If AI-driven spend slows down, Nvidia might not meet its revenue or profit targets, which could decrease the normalized EPS the stock achieves and subsequently reduce the stock’s value for investors.

Nvidia is undoubtedly a great company, but it’s only a great stock to buy at the right price.

Analysts’ Price Target

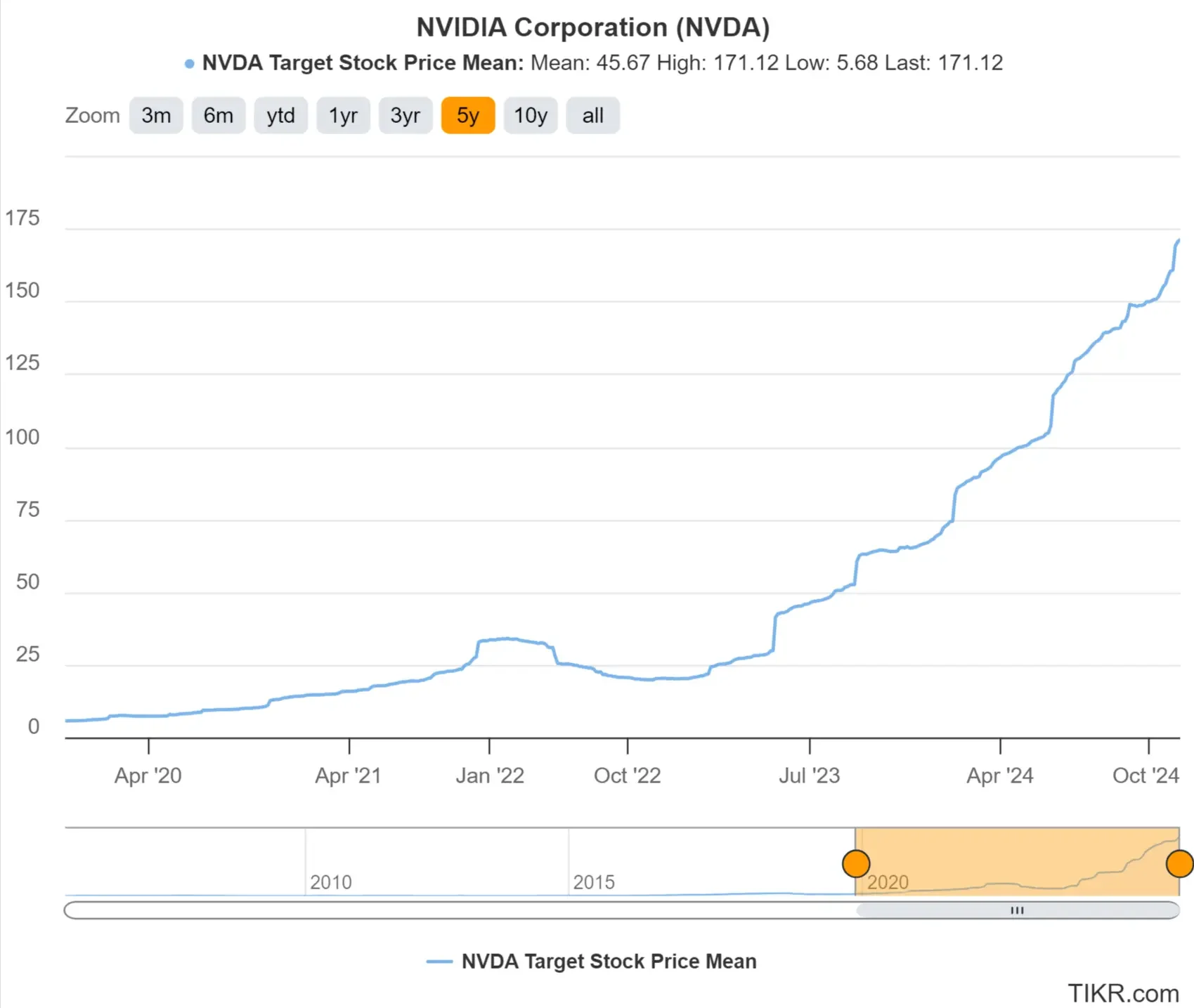

The consensus analyst price target for Nvidia today is about $171 per share, which means analysts see considerable upside for the stock:

Analysts’ price targets can suffer from many biases and aren’t always accurate.

Still, looking at analysts’ consensus price target can be a great way to get a “second opinion” on your own stock valuation.

TIKR Takeaway

Based on the 2-Minute Valuation Model, it looks like Nvidia stock is slightly undervalued today and could offer a 34% return over the next 2 years. However, the stock could still be risky because of the company’s dependence on AI-driven spending.

Don’t take our word for it—try it out for yourself! Analyze Nvidia stock or any stock you’re interested in on TIKR today!

The TIKR Terminal offers industry-leading financial data on over 100,000 stocks and was built for investors who think of buying stocks as buying a piece of a business.

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. We aim to provide informative and engaging analysis to help empower individuals to make their own investment decisions. Neither TIKR nor our authors hold positions in any of the stocks mentioned in this article. Thank you for reading, and happy investing!