What Are Dividend Stocks?

Dividend stocks are stocks that pay regular dividends to their shareholders. A dividend is a portion of a company’s earnings that a company can pay out as cash to its shareholders, usually quarterly. Dividend stocks are popular among retirees and investors seeking consistent, steady income from their portfolio holdings.

High-quality dividend-paying stocks generally pay dividends in any economic environment, so dividends can reassure investors that they will make a steady cash return from their investments, even during a market downturn.

Why Do Companies Pay Dividends?

A company doesn’t pay dividends to shareholders out of the goodness of its heart or as a charitable act.

Companies pay dividends to return capital to shareholders because, ultimately, a business is owned by its shareholders.

Most publicly traded businesses are economically incentivized to increase shareholder returns. So, if a business has extra profit that it can’t invest efficiently, management will often return this cash to shareholders as dividends. This ultimately enriches shareholders.

Companies pay dividends for several reasons, all of which can be particularly appealing to long-term investors:

- Efficient Capital Allocation: Dividends are a way for companies to return excess capital to shareholders, especially when the company has fewer opportunities for high-return investments as the company matures. Companies can distribute profits to shareholders instead of sitting on cash or reinvesting in low-return projects.

- Signal of Financial Health: Regular dividend payments signal that a company generates sufficient profits and has stable cash flow, which can increase investor confidence. This is especially true for companies with a long history of consistently paying and increasing dividends, as it suggests reliable earnings and prudent management.

- Attracting Income-Focused Investors: Companies that pay dividends are attractive to income-focused investors, such as retirees, looking for a steady income stream. Paying dividends can broaden a company’s investor base, particularly among those who prioritize income over growth.

Find high-quality, undervalued stocks to buy today with TIKR >>>

Important Dividend Dates

When investing in dividend-paying stocks, it’s important to understand the key dividend dates that determine an investor’s eligibility for receiving dividends:

- Declaration Date: The date the company’s board of directors announces the dividend payment. This includes the amount to be paid, the ex-dividend date, the record date, and the payment date.

- Ex-Dividend Date: This is the cutoff date for determining dividend eligibility, so investors must buy shares before this date to receive a dividend.

- Record Date: This is when a company records the shareholders who will receive the stock’s upcoming dividend. This date is usually the same as the ex-dividend date or follows it by one business day.

- Payment Date: When the dividend is actually paid to eligible shareholders, and cash is deposited into the shareholder’s brokerage account.

Example: Consider a company like Coca-Cola, which declared a dividend on July 29, 2024. The ex-dividend date is set for September 13th, 2024, meaning you must own the stock on September 12th or earlier to be eligible for the dividend. The record date is also September 13th, and the dividend payment date is October 1st, 2024, when eligible shareholders receive the dividend in their brokerage account.

Is Dividend Investing a Good Investing Strategy?

Dividend investing can be an effective strategy for long-term investors, but like all investing strategies, it comes with both pros and cons:

Pros:

- Steady Income Stream: Dividend stocks provide regular income, which can be particularly valuable for retirees or those looking to generate passive income from their investments.

Example: There’s a popular movement for investors to retire from dividends by building a massive dividend portfolio and then living off of dividend income generated from the portfolio.

If investors built a dividend portfolio worth $2 million, and the average dividend yield across the portfolio was 5%, an investor would earn $100,000 in annual dividend income.

This is truly passive income, and in a well-diversified portfolio, investors would have a low risk of seeing their portfolio income drop from dividend cuts because most financially healthy dividend-paying companies continue paying dividends for years.

Investors would also see their portfolio rise in value as dividend stocks tend to appreciate, which means their portfolio would snowball over time while kicking off dividend income.

- Potential for Long-Term Growth: Companies that pay dividends often have stable earnings and a solid business model, making them potentially less volatile than non-dividend-paying stocks. Dividend stocks can sometimes offer a higher total return than non-dividend-paying stocks.

- Compounding Returns: Reinvesting dividends can lead to your holding significantly increasing in value over time through the power of compounding, leading to higher returns.

Cons:

- Limited Growth Potential: Companies that pay high dividends will have fewer retained earnings to reinvest in growth, which can limit the stock’s potential for capital appreciation.

- Tax Implications: Dividend income is generally taxable at a low capital gains rate, which can reduce an investor’s overall return, especially in higher tax brackets.

- Dividend Cuts: If a company’s earnings decline, it may reduce or eliminate its dividend, leading to a sharp decline in the stock price and loss of income for investors.

Analyze stocks quicker with TIKR >>>

How to Invest in Dividend Stocks

Here are some strategies for investing in dividend stocks:

- Assess the Stock’s Dividend Track Record: It’s important to look for stocks with a consistent history of increasing their dividends to shareholders. Dividend Aristocrats are companies in the S&P 500 that have consistently increased their dividends for at least 25 consecutive years. Companies like these are often viewed as reliable investments for income-focused investors.

- Diversify Across Sectors: Spreading investments across different industries can reduce risk and provide a more stable income stream, as different sectors may perform well at different times.

- Consider Dividend ETFs: Exchange-Traded Funds (ETFs) that focus on dividend-paying stocks offer a diversified portfolio of dividend stocks, reducing individual stock risk.

Metrics to Assess Dividend Stocks

By assessing these key dividend metrics, dividend investors can determine whether a dividend-paying stock is high-quality:

- Dividend Yield: This metric shows the annual dividend payment as a percentage of the stock’s current price, with the formula Annual Dividends per Share / Current Stock Price. It provides insight into the income return on investment. However, a very high yield may also indicate a higher risk to the company, such as a declining stock price or potential dividend cut.

Fast Fact: We generally consider a low dividend yield to be below 2%, a medium dividend yield to be between 2 to 5%, and a high dividend yield to be above 5%.

- Payout Ratio: The payout ratio measures the percentage of earnings a company distributes as dividends with the formula Dividends Paid / Net Income. A lower payout ratio suggests the company has room to maintain or increase its dividends. In comparison, a higher payout ratio may indicate the business pays too much of its earnings as dividends, and the dividend could be at risk if earnings decline.

Fast Fact: We generally consider a low/safe dividend payout ratio to be below 70%, a moderately concerning payout ratio to be between 70 and 90%, and a highly concerning payout ratio to be above 90%.

- Dividend Growth Rate: This measures the rate at which a company’s dividend payments have increased over time. Consistent dividend growth is often a sign of a financially healthy company with stable cash flows, making it an attractive choice for long-term investors.

Fast Fact: We generally consider low dividend growth to be below 3% annually, moderate dividend growth to be between 3 and 6% annually, and high dividend growth to be above 6% annually.

- Dividend Forecast: Investors can gauge a company’s projected dividend growth to forecast future dividend income and assess whether the company is likely to sustain or increase its dividends.

Fast Fact: We generally consider a low dividend growth forecast to be below 2% annual growth, a moderate dividend growth forecast to be between 2 and 5% annual growth, and a high dividend growth forecast to be above 5% annual growth.

- Current Dividend Yield Compared to Historic Yields: Comparing the current dividend yield to its historical average can help investors determine whether a stock is under or overvalued. A stock with a current dividend yield higher than its historical average could indicate a buying opportunity.

Things to Watch Out for with Dividend Stocks

While dividend stocks can be appealing, there are several things investors should be cautious about:

High Payout Ratios

A very high payout ratio may indicate that a company returns too much of its earnings to shareholders, leaving little room for growth or cushioning against future downturns.

See 5 Red Flags That a Stock Could Be a Value Trap >>>

Dividend Cuts

If a company has reduced its dividends during economic downturns or periods of financial stress in the past, it might do it again in the future. Investors looking for long-term, consistent dividend payments should pay attention to this.

Extremely High Dividend Yields

Often, companies offering exceptionally high dividend yields for their industry might have some problems below the surface. Since the dividend yield takes the company’s annual dividend and is divided by the current share price, it will rise if the share price falls.

Sometimes, a stock will fall because of problems in the underlying business, and the dividend yield will rise, luring unaware investors into thinking it’s a high-yielding dividend stock when the business is actually struggling.

If you’re a dividend investor looking for high-yielding stocks, the best way to avoid this is to focus on finding high-quality businesses first before chasing after stocks with the highest possible dividend yield.

Do Dividend Stocks Outperform Non-Dividend Stocks?

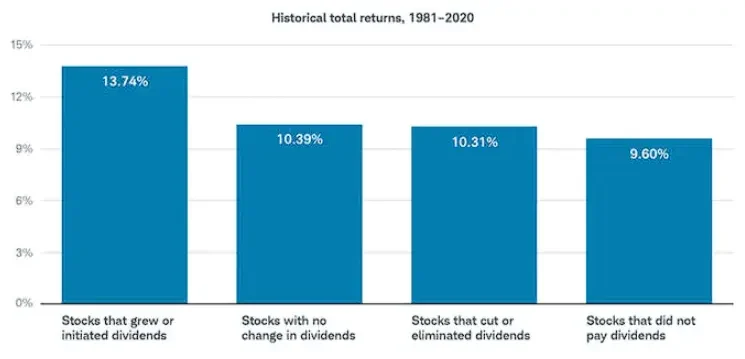

In a study done by Ned Davis Research, it was found that over the past 40 years, stocks that had grown or initiated their dividends had outperformed stocks that didn’t pay dividends:

However, the results aren’t as clear-cut as simply saying dividend stocks outperform non-dividend stocks.

Dividends are Paid from Earnings

First, it’s important to remember that dividends are paid directly from a company’s earnings. That means that instead of investing in growth opportunities, paying down debt, or repurchasing shares, the company paid its earnings directly to shareholders.

Logically, this makes it difficult to comprehend why dividend-paying companies would outperform. If a company could generate high returns on invested capital by investing in its business, it would make sense that the business would make the most money for shareholders by retaining 100% of its earnings and reinvesting in growth projects that would yield high returns on capital.

When you consider that dividend-paying companies have outperformed, it makes you consider whether most companies simply lack high-return growth opportunities to allocate capital towards. Perhaps some businesses don’t have ways to reinvest capital at high rates of return and are better off giving shareholders a guaranteed return through dividend payments.

Survivorship Bias

These kinds of studies also exhibit some survivorship bias. Dividend-paying companies must generally be profitable and have strong financial health before they can distribute earnings to shareholders. By extension, this means that the non-dividend-paying companies group probably has a higher percentage of unprofitable companies with poor financial health.

Both Dividend-Paying & Non-Dividend Stocks Can Be Good Investments

Simply put, just because dividend-paying stocks have outperformed does not mean that dividend stocks are better investments than non-dividend-paying stocks. It’s more important to look for businesses that are financially healthy, growing, and generating high returns on invested capital because these businesses are strong regardless of whether they pay dividends or not.

Are Stock Buybacks or Dividends Better?

Both stock buybacks and dividends are ways for a company’s management to return capital to shareholders.

Neither is intrinsically better than the other, although stock buybacks may offer slight tax advantages.

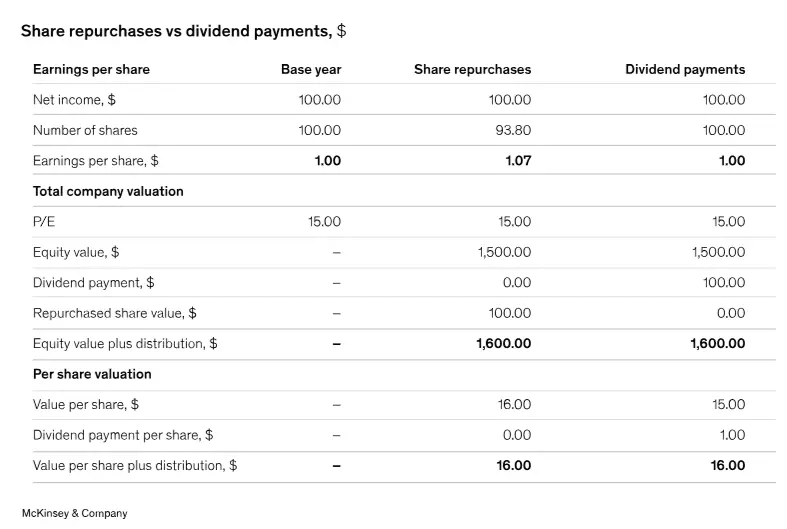

This visual from McKinsey & Company shows that there’s no difference in value creation for shareholders between stock buybacks and dividends:

However, some people might prefer stock buybacks because they’re more tax-advantaged.

Why Stock Buybacks are Tax-Advantaged

When dividends reach an investor’s brokerage account, they generally are counted as qualified dividends, which are taxable at a low capital gains tax rate. Investors must pay taxes on dividends they receive.

However, stock buybacks aren’t taxable events for investors because the company simply bought its own stock. The catch is that stock buybacks help to grow the stock price, which leads to increased capital gains. Eventually, when investors sell the stock, they’d ultimately have to pay a higher capital gains tax because the stock had risen more in price.

Why Dividends Can Be Better for Low-Quality Businesses

Additionally, stock buybacks carry an extra risk because management buys into its own stock. If the company significantly decreases in value, management will have destroyed shareholder value by buying overpriced stock.

Ultimately, dividends and stock buybacks both have the same impact on an investor’s total returns, but buybacks might be slightly preferred because they are slightly tax-advantaged.

FAQ Section:

Are dividend stocks good investments?

Dividend stocks can be good investments because they are often well-established companies with a history of stable earnings and provide investors with a steady income stream.

Where can you buy dividend stocks?

Dividend stocks can be purchased through online brokerage platforms like Charles Schwab, Fidelity, Robinhood, or E*TRADE. You can also buy them directly through some companies’ direct stock purchase plans (DSPPs) or via a financial advisor.

How can you buy dividend stocks?

You can buy dividend stocks through a brokerage account by selecting stocks that pay regular dividends. It’s important to research the company’s financial health, dividend history, and payout ratio to make sure that the stock can continue paying dividends for years to come.

When should you sell dividend stocks?

You should consider selling dividend stocks if the company’s financial health deteriorates if the company cuts or suspends its dividend, or if you need to rebalance your portfolio. Selling may also be wise if the stock becomes significantly overvalued compared to its intrinsic value.

How do you start investing in dividend stocks?

To start investing in dividend stocks, individuals can open a brokerage account, research companies with a strong dividend history, and purchase shares when they feel they’ve found good stocks. Diversifying your holdings across various sectors can also reduce risk inside your portfolio and increase potential income stability.

TIKR Takeaway:

Dividend stocks can be a valuable addition to a long-term investment strategy, offering passive income and the potential for capital appreciation.

By understanding how dividends work, the reasons companies pay them, and the risks involved, investors can make informed decisions about incorporating dividend stocks into their portfolios.

The TIKR Terminal offers industry-leading financial data on over 100,000 stocks, so if you’re looking to analyze stocks for your portfolio, you’ll want to use TIKR!

TIKR offers institutional-quality research for investors who think of buying stocks as buying a piece of a business.

Find the best stocks to buy today with TIKR >>>

Disclaimer:

Please note that the articles on TIKR are not intended to serve as investment or financial advice from TIKR or our content team, nor are they recommendations to buy or sell any stocks. We create our content based on TIKR Terminal’s investment data and analysts’ estimates. We aim to provide informative and engaging analysis to help empower individuals to make their own investment decisions. Neither TIKR nor our authors hold any positions in the stocks mentioned in this article. Thank you for reading, and happy investing!